FREE REPORT

FREE REPORT

Buy Now, Pay Later (BNPL)

The Ultimate ASX Sector Report

Written by Cathryn Goh, Investment Analyst at Rask Australia. Edited by Owen Raszkiewicz, Lead Investment Analyst at Rask Australia. Designed by Sophie Ymer, Head of Design at Rask Australia.

What is buy now, pay later?

As the name implies, BNPL allows consumers to buy something now and pay for it over time in instalments. It’s similar to the old lay-by system, except you’re able to take the items home before paying it off. This is because the BNPL provider (e.g. Afterpay) pays the merchant in full and upfront when you complete a transaction. So when you’re making your repayments, the money is going to the BNPL provider and not the merchant/retailer (since they’ve already been paid).

For consumers, the fees associated with BNPL differ from provider to provider but it’s generally a much cheaper option than traditional credit, which can attract interest rates of 20%+.

From a merchant or retailer’s perspective, BNPL providers typically collect anywhere from 3-6% of the transaction value from merchants.

Compared to the standard ~1% processing fee charged by the likes of Visa and Mastercard for card transactions, BNPL providers are getting a hefty slice of the purchase price. What’s more, merchants aren’t able to pass these BNPL fees on to customers, unlike the surcharge that can be applied when accepting payment via credit or debit cards.

You might be wondering why merchants are willing to pay BNPL providers such high fees for simply offering their services. This can be explained by the valuation proposition posed to merchants.

According to BNPL provider Splitit, the single biggest challenge for e-commerce retailers is overcoming ~70% cart abandonment by shoppers. This supposedly translates into US$4.6 trillion in lost e-commerce sales each year.

This is where BNPL products come in.

As many BNPL providers have been touting for some time now, adopting an instalment solution typically translates into incremental growth for merchants through higher conversion rates and larger carts.

For example, in its recent FY20 results presentation, Afterpay cited retail survey data that found 83% of retailers using Afterpay see improving conversion and fewer cart abandons, while 72% of retailers see expanding average order values and basket sizes.

Is buy now, pay later good?

For those who are responsible spenders and are able to keep on top of repayments, BNPL products can effectively be used as a budgeting tool to spread out payments and manage cash flow.

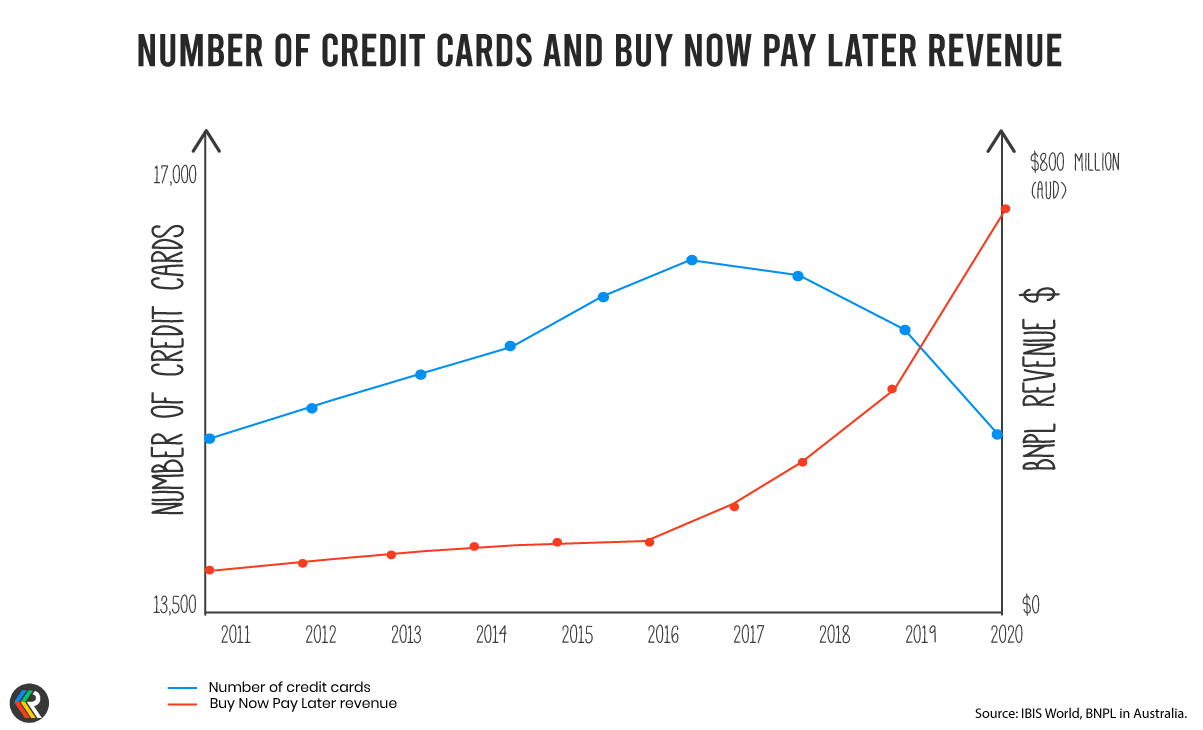

This comes as the popularity of credit cards continues to stall, with consumers turning their backs on traditional credit in favour of debit cards and BNPL products.

However, BNPL can be a slippery slope as it can encourage consumers to spend beyond their means and splurge on impulse purchases. Consumers also run into trouble when they’re not able to make repayments on time, which adds to the financial burden and may also have ramifications for credit ratings. Comparison firm Mozo conducted a survey in April 2020 and found that 69% of Aussies with a BNPL account said they were ‘financially stressed’ by their payments schedule.

Another widely-debated topic when it comes to BNPL is whether or not it is considered a form of credit. Traditional BNPL products aren’t deemed ‘consumer credit’ under the National Credit Code, and the industry has, thus far, operated with little regulatory oversight.

How big is the industry?

According to Zip’s FY20 results presentation, the global retail market is estimated at $22 trillion dollars. The US represents a $5 trillion opportunity, while the UK and Australian retail markets are valued at $630 billion and $320 billion, respectively.

Afterpay didn’t include total addressable market (TAM) figures in its most recent results presentation but has referenced its online retail opportunity in the past. Focusing on just the online opportunity reins in these figures to $630 billion in the US, $130 billion in the UK and $30 billion in Australia.

Before we go any further, it’s important not to get caught up in the numbers and take management’s (often promotional) word as gospel. Sure, the entire retail market on the face of this earth may be worth $22 trillion, but can you envision a world where the only payment option was to buy now and pay later?

To reference some industry figures, Worldpay, a subsidiary of US fintech giant FIS Global, releases a global payments report each year. According to the most recent report, BNPL accounted for 1.6% of global e-commerce transactions in 2019, and is forecast to grow its share to 2.8% in 2023.

And this is before we even consider that BNPL companies don’t operate across every vertical, every segment of the market, and in every country.

This is all to say that BNPL companies certainly don’t have trillions of dollars at their door steps. And the fact that management would be highlighting these figures in the first place perhaps speaks to their credibility and promotional focus.

For another perspective, IBISWorld forecasts Australian BNPL revenue to rise by 9.1% in 2020-21 to $741.5 million. Looking out further, the research firm estimates BNPL revenue to grow at an annualised rate of 9.8% over the five years through to 2024-2025, arriving at $1.1 billion of revenue.

BNPL landscape on the ASX

Believe it or not, the ASX is the pre-eminent stock exchange for buy now, pay later companies. That means, Australian investors are some of the few investors on the planet who have access to the BNPL industry. Aside from the host of names on the ASX, the rest of the BNPL sector primarily lies in the private sector.

Explaining the decision to list on the ASX and not its local market, Laybuy founder and managing director Gary Rohloff said, “the ASX is the most sophisticated buy now pay later market in the world … and it makes sense to be part of it.”

US e-commerce company Zebit has also turned its back on its local market and is eyeing off an IPO on the ASX in coming months.

So what’s all the hype about?

Let’s shine a spotlight on each ASX company cashing in on the BNPL wave.

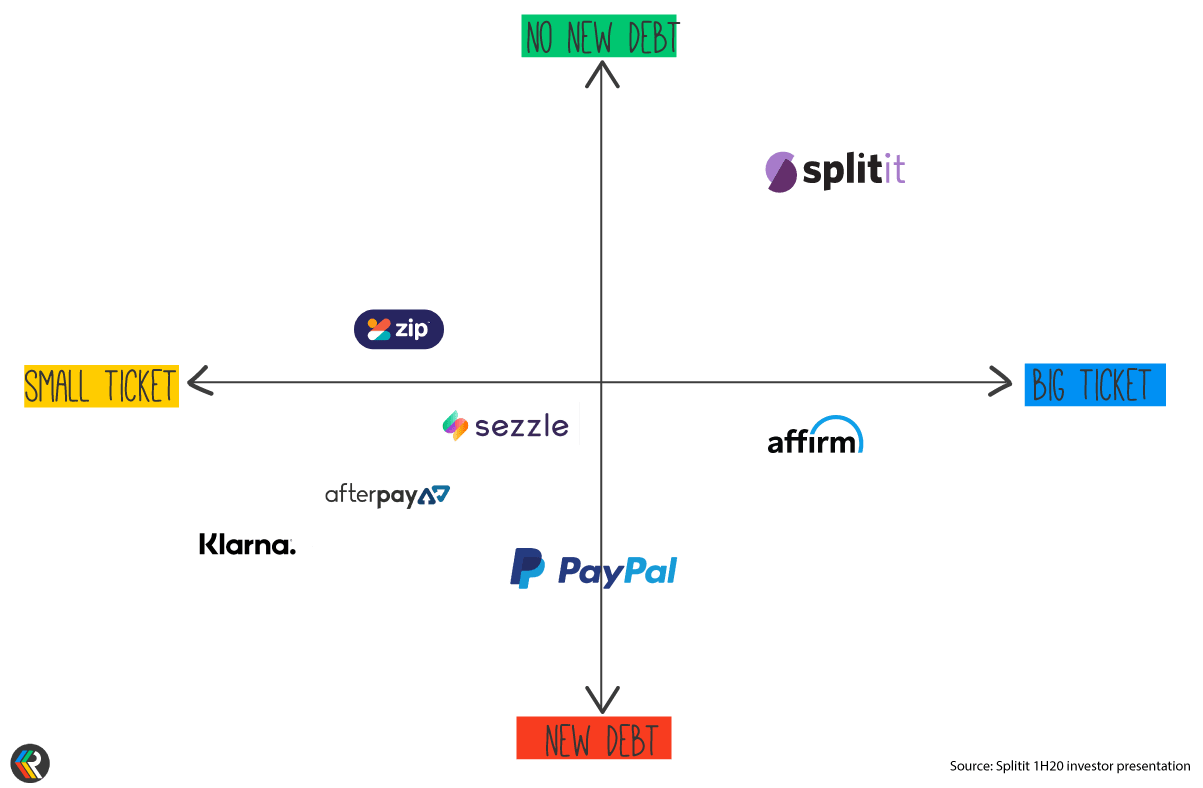

To get the ball rolling, here’s an overview of the global BNPL landscape, courtesy of Splitit:

Afterpay Ltd (ASX: APT)

Founded: 2014

Listed: 2016 (and then merged with Touchcorp in 2017)

Headquarters: Melbourne, Australia

Where it operates: Australia, New Zealand, the USA, the UK and most recently, Canada

Upcoming regions: Europe (Spain, Italy & France) and potentially Asia

Active customers: 9.9 million as at 30 June 2020

Active merchants: 55,400 as at 30 June 2020

Market darling Afterpay has charged up the ASX ranks this year, commanding a market capitalisation greater than the likes of Coles Group (ASX: COL), Woodside Petroleum (ASX: WPL) and Ramsay Health Care (ASX: RHC) at the time of writing.

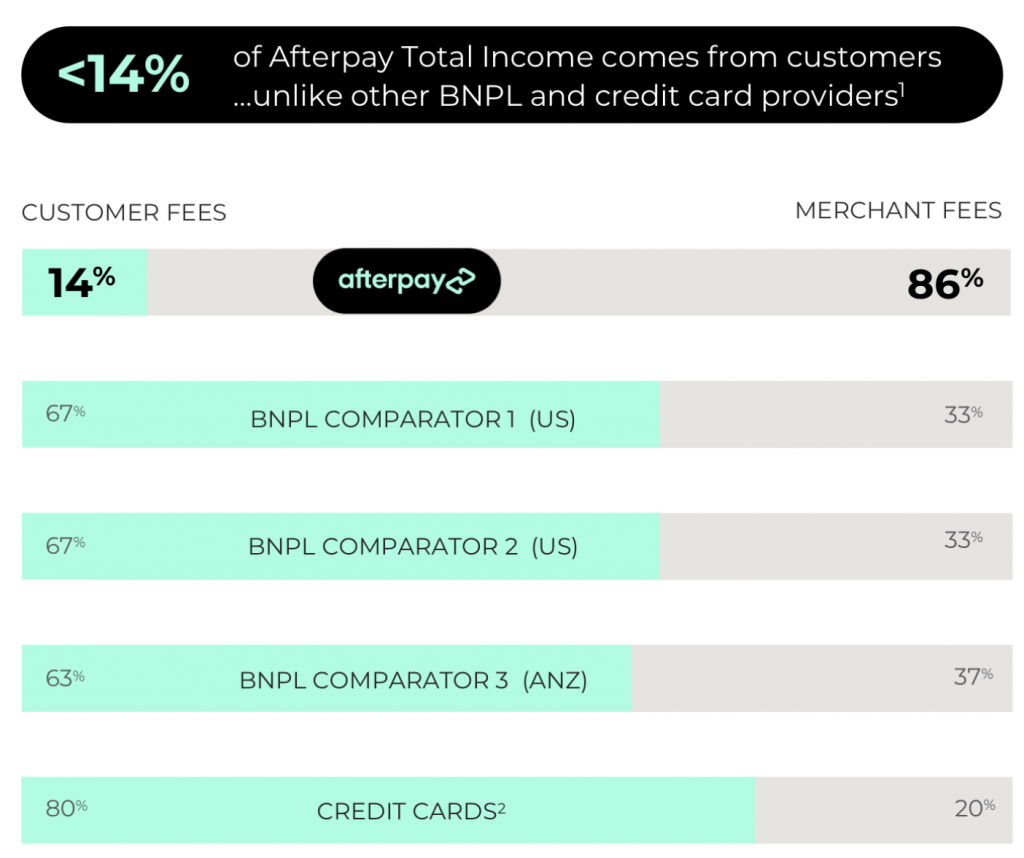

Afterpay’s business model primarily generates revenue from merchants, charging an average 3.9% merchant fee on each transaction. It also collects late fees from customers who fail to make repayments on time. In FY20, 86% of Afterpay’s income came from merchants.

Source: Afterpay FY20 results presentation

FY20 results

For the full-year, Afterpay processed $11.1 billion of underlying sales, up 112% on the prior year. This led to income of $502.7 million, up 103% from $247 million in FY19. Including late fees and revenue from the Pay Now business, total income came in at $519.2 million, up 97%.

Afterpay’s net transaction loss (gross loss minus late fees) for the year was $42.8 million, representing 0.38% of underlying sales – a slight improvement from 0.42% in the prior year. Late fees grew at a slower rate than the increase in underlying sales, coming in at $68.8 million (13.7% of Afterpay total income or 0.6% of underlying sales). Gross loss also reduced as a percentage of underlying sales, coming in at a historic low of 0.9%.

On the bottom line, Afterpay reported a statutory loss after tax of $22.9 million, an improvement on the $43.8 million loss recorded in FY19. The company’s operating loss also improved, coming in at -$4.6 million compared to -$31.7 million in the prior year.

Growth strategy

Looking ahead, Afterpay is focused on expanding globally to deepen retailer partnerships, increasing acceptance from small to medium-sized businesses in newer markets, and utilising brand and innovation to drive customer acceptance and retention.

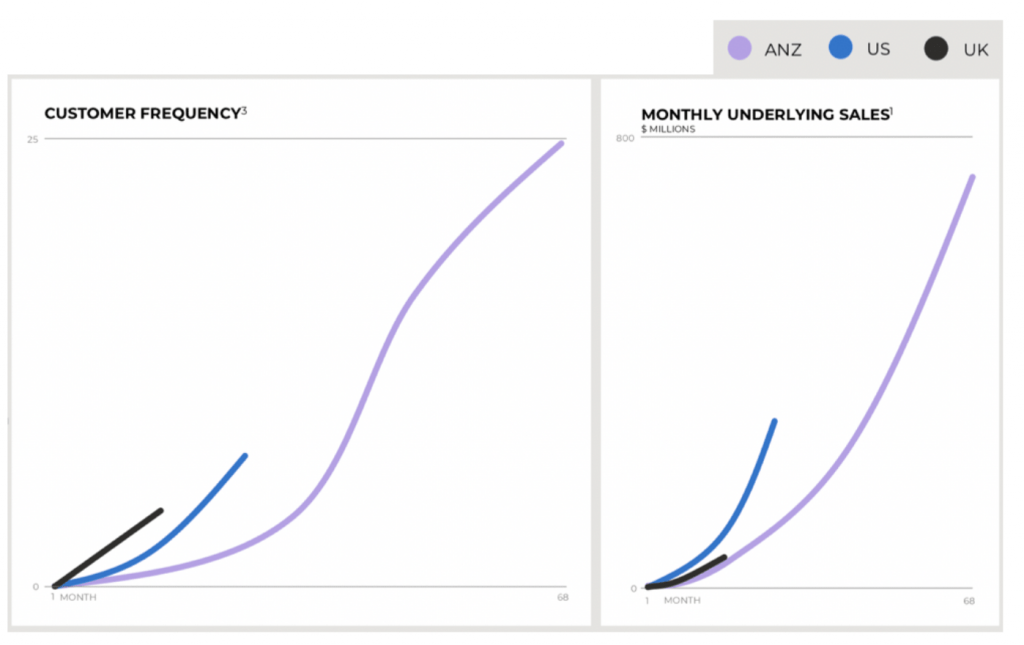

In terms of global expansion, Afterpay is forging a path in the US and UK markets, which are still relatively green. The company noted these newer markets are following a similar customer frequency trajectory to the blueprint established by the more mature ANZ business. However, as you can see in the chart below on the right, the US is scaling at a faster rate.

Source: Afterpay FY20 results presentation

Afterpay launched in Canada in August 2020 with retailers such as American Eagle, Dermalogica and Herschel. And following its recently-announced acquisition of Pagantis, Afterpay is working towards launching in Spain, France, Italy and potentially Portugal as it looks to contend with Swedish fintech giant Klarna in the European market. It’s worth noting that despite holding leading positions in the Nordic and DACH regions, Klarna isn’t as established in southern Europe.

To top things off, Afterpay also has its eye on the Asian market. An in-region team will be established in Asia through a small acquisition of Singapore-based company EmpatKali. What’s more, Afterpay is exploring opportunities to leverage the network of strategic investor Tencent to expand into new regions in Asia.

Turning to innovation, Afterpay continues to roll-out new features such as the ability to create wish lists and favourites, persistent login and express checkout. The company has also introduced Pulse, a loyalty program that aims to reward responsible spending and provides access to exclusive discounts and promotions. Pulse launched in the UK in July, with ANZ and the UK next in line.

Additionally, Afterpay’s cross border trade (XBT) trade platform is progressively being rolled out into new regions, and the company is looking to expand merchant insights and tools. In regard to the latter, we think data analytics is a lucrative path Afterpay could decide to venture down in time.

Zip Co Ltd (ASX: Z1P)

Founded: 2013

Listed: 2015 – initially as zipMoney (ASX: ZML)

Headquarters: Sydney, Australia

Where it operates: Australia, New Zealand, the USA, and the UK. It also owns a ~25% stake in South African BNPL company Payflex.

Active customers: 2.1 million as at 30 June 2020

Active merchants: 24,500 as at 30 June 2020

Zip’s core business model differs from Afterpay in that it charges customers a $6 monthly account fee in addition to late fees. In Australia, the company’s digital wallet comprises two products: Zip Pay and Zip Money. Zip Pay is your standard interest-free BNPL product with a limit of $1,000 – $1,500. Zip Money, however, has limits between $1,000 and $50,000, and charges interest (after a minimum three-month interest-free period) as well as a one-off establishment fee.

Unlike Afterpay who started afresh in global markets, Zip has broadened its horizons by acquiring overseas BNPL companies. In August 2019, Zip purchased New Zealand-based PartPay, which has now been rebranded under the Zip banner. This acquisition came with an 8.7% stake in US-based QuadPay and a 24.7% stake in South African company Payflex. In June 2020, Zip announced its intention to acquire QuadPay in an all-scrip deal worth $403 million.

The acquisition, which was completed at the beginning of September 2020, delivers more than US$70 million in monthly transaction volume and over 2 million customers to Zip.

FY20 results

Zip’s full-year revenue jumped by 91% over the prior year to $161 million. This was helped by a similar 91% increase in total transaction volume (TTV) to $2.1 billion. The company’s loan book (receivables) rose by 73% to $1.18 billion, while its bad and doubtful debts expense more than doubled to $53.7 million.

Further down the income statement, gross profit grew by 68% to $51.6 million, however, the net loss worsened by 80% to $20 million. At the end of the period, Zip had $32.7 million cash sitting on its balance sheet and $1.08 billion of debt.

Growth strategy

In its FY20 results presentation, Zip highlighted three growth levers that will drive the company’s success into the future:

- Customers – drive acquisition and deepen engagement

- Merchants – drive more traffic and launch business instalments

- Global expansion – integrate PartPay, invest in new markets and consolidate QuadPay

On the customer side, Zip fast-tracked its Shop Everywhere feature at the onset of COVID-19. Shop Everywhere generates a single-use virtual card at checkout and enables customers to shop at any online merchant inside the Zip app, interest-free.

Turning to merchants, in late 2019, Zip acquired the ANZ operations of global SME lending provider Spotcap (which it has now rebranded to Zip Business). The rationale behind this acquisition was to fast-track Zip’s entry into the business lending market.

Zip made waves in August 2020 when it announced a partnership with eBay to launch its business lending product Zip Business. The partnership will allow Zip to offer working capital finance to the 40,000 Australian small and medium-sized businesses using the eBay platform.

In terms of global expansion, the company is preparing to launch the Zip brand in the UK market by the end of the year. Naturally, it is also focused on consolidating the QuadPay acquisition and accelerating growth in the US. Back in July, Zip said that post-acquisition, the combined company will have pro-forma annualised TTV of $3.2 billion, annualised revenue of $252 million and 3.9 million customers.

Sezzle Inc (ASX: SZL)

Founded: 2016

Listed: 2019

Headquarters: Minneapolis, US

Where it operates: the USA and Canada

Upcoming regions: India

Active customers: 1.5 million as at 30 June 2020

Active merchants: 16,112 as at 30 June 2020

Sezzle’s business model most closely resembles that of Afterpay. The most obvious difference is that Sezzle provides customers with the option to reschedule a repayment to avoid a US$10 late fee. Customers are granted one free reschedule option per order, and two $5 reschedules after that.

HY20 results

Sezzle has a financial year ending 31 December, so its recent August results was a half-year report.

Sezzle saw underlying merchant sales grow 338% to US$307.4 million, while total income jumped by 384% to US$20.8 million. Merchant fees represented 84% of total income in the half.

Gross profit increased five-fold to US$12.1 million. However, selling, general and administrative expenses of US$13.22 million (up 191%) and receivables impairment expenses of US$5.1 million (up 194%) led to a US$6.2 million operating loss. After factoring in interest expenses and income tax, Sezzle reported a net loss of US$8.2 million, which compares to a loss of $US4.8 million in 1H19.

Growth strategy

Looking ahead, Sezzle is focused on global expansion and product innovation. The company noted that the trajectory of its Canadian effort, which was launched in May 2019, has matched the US at similar points in the life cycle. It is currently conducting testing in India and is exploring opportunities in Europe.

In regard to product innovation, Sezzle introduced four consumer offerings in the last half: Sezzle Up, Sezzle Anywhere, Sezzle Spend, and an in-store virtual card solution.

Sezzle Up is a credit-building program that consumers can opt in to build their credit scores. By joining Sezzle Up, customers increase their transaction limit and can build their credit rating by keeping their account in good standing. However, in order to join, customers must link a bank account to Sezzle and set it as primary. This allows Sezzle to reduce processing costs, and thus collect a greater margin on transactions from these users.

By joining Sezzle Up, customers will have access to Sezzle Anywhere, which allows customers to use Sezzle at highly-requested stores that usually wouldn’t offer Sezzle as a payment option. This is made possible through gift cards, which Sezzle purchases from merchants at a discount and then sells to customers at face value. Additionally, Sezzle generates affiliate revenue for each order placed using Sezzle’s unique affiliate links. Sezzle has signed up leading merchants like Nike, Sephora and Home Depot to this program.

Sezzle Spend is a rewards program which can be used to increase loyalty to Sezzle and its retail partners. The program incentivises certain actions such as shopping, linking a bank account and using it to pay for instalments, sharing a purchase on social media, and downloading the app.

Finally, Sezzle has been developing an in-store solution which will allow customers to apply for a virtual card that will sit in their Google or Apple mobile wallets. As it stands, nearly 100% of Sezzle’s transactions are e-commerce. According to Sezzle, its integrations with Google Pay and Apple Pay allow it to reach in-store integrations with near-zero integration work.

Splitit Ltd (ASX: SPT)

Founded: 2012

Listed: 2019

Headquarters: New York, US

Active customers: 149,000 as at 30 June 2020

Active merchants: 519 as at 30 June 2020

Splitit is the most unique BNPL provider on the ASX as it doesn’t extend credit to customers – it simply utilises customers’ existing lines of credit.

What’s more, unlike with other BNPL providers, there are no application processes involved – customers don’t need to sign up to Splitit. Instead, Splitit is simply available at the checkout at participating merchants. For example, if you shop at Kogan, you might have noticed Splitit is listed as a payment option. When you’re checking out, you can just select to pay via Splitit, enter your card details and complete the transaction. Interestingly, Splitit doesn’t have a mobile application.

So where does the buy now, pay later part come in? Well, Splitit will break up the transaction into instalments (between three and 36 repayments, typically paid on a monthly basis). The first instalment will be charged to your card at the point of sale and the remaining balance is held against your credit limit.

Notably, Splitit does not charge any fees to customers and does not assume credit risk – the risk of customer default lies with the credit card provider. Splitit’s system will ‘pre authorise’ the transaction value, so the merchant knows you have the money available.

Splitit generates all of its income from merchants, charging fees that start at 1.5% and US$1.50 per transaction.

Splitit targets the higher-value end of the market, often reporting an average order value abpve US$800 (~A$1,100). Conversely, Afterpay’s average order value sat around $153 in 2020. Splitit’s key verticals include homewares, luxury retail, jewellery and health.

From what we can tell, Splitit doesn’t restrict itself to certain countries. Instead, it signs up merchants who then offer Splitit as a payment option to customers in the countries they service. When Splitit went public at the beginning of 2019, it said it had more than 310 merchants in 25 countries across North America, Europe, Asia and Australia.

HY20 results

Like Sezzle, Splitit recently released its half-year results for the six months ending 30 June 2020. The company reported merchant sales volume of US$89.1 million, representing year-on-year growth of 133%. This helped Splitit grow its gross revenue by 244% over the prior year to US$3.1 million.

Splitit is still very much in its heavy growth phase. R&D expenses doubled to US$1.7 million, while sales & marketing expenses and general & admin expenses both jumped 146% to US$3.8 million and US$4.4 million, respectively.

On the bottom line, Splitit reported a net loss after tax of US$9 million, which compares to a US$3.8 million loss in the year-ago period.

Growth strategy

For one, Splitit is focused on technology-enabled strategic and distribution partnerships to drive industry innovation and scalable growth.

To this end, the company is looking to consolidate the partnerships it signed with Stripe, Visa and Mastercard in 2020.

Splitit partnered with payments giant Stripe to integrate its solution with Stripe Connect. This will provide technology to enable merchants to self-onboard to Splitit’s platform, accelerating the merchant onboarding process from weeks to minutes.

A couple of months later, Splitit announced a partnership with Visa to help accelerate the distribution of instalment payments for merchants. Splitit said it will leverage the Visa Developer Platform to participate in the ongoing innovation of the global instalment payments landscape. It will also integrate with Visa Installment Solutions, a new capability being offered to Visa’s merchant network to allow Visa cardholders more control over how a purchase is paid.

Finally, Splitit made waves in June when it unveiled a partnership with Mastercard, causing its share price to more than double on the day of the announcement. In an effort to accelerate global adoption, Splitit will integrate its instalment solution with Mastercard’s suite of technology as a network partner to enable merchants to offer seamless consumer experiences at checkout, both in-store and online.

FlexiGroup (ASX: FXL)

Founded: 1991

Listed: 2006

Headquarters: Sydney, Australia

Where it operates: Australia, New Zealand and Ireland

Active customers: 2.1 million as at 30 June 2020

Active merchants: 56,700 as at 30 June 2020

Unlike the other BNPL companies on this list, FlexiGroup isn’t a pure-play BNPL company. The company considers itself “Australasia’s original fintech”, rising to fame with its consumer leasing product FlexiRent, which was launched in the early 1990s.

FlexiRent allowed consumers to lease household items like washing machines and computers without having to pay the full amount upfront. Think of it as a rent now, pay later product.

Notice how we’re using past tense?

FlexiRent was eventually phased out in 2018. Recognising the changing times, the company released its BNPL product humm the following year.

One of humm’s key marketing points is ‘no interest ever’. The standard humm product allows customers to buy ‘little things’ (up to $2,000) and pay them off either weekly or fortnightly. The only fees incurred are late fees if customers fail to meet their payment obligations. Consumers can also purchase ‘big things’ (up to $30,000), which incurs ongoing monthly fees, establishment fees, repeat purchase fees and late payment fees but notably, no interest.

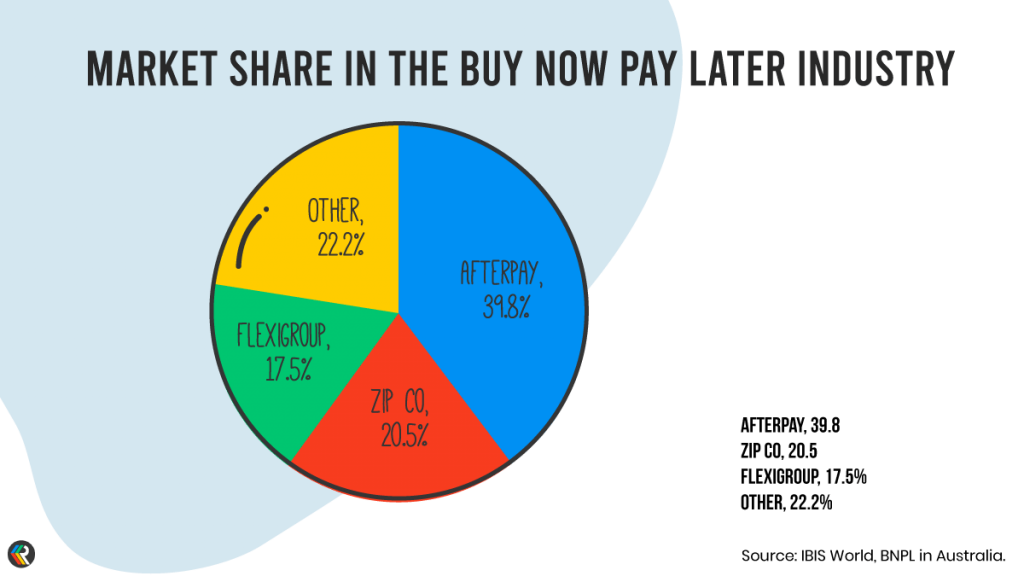

According to FlexiGroup, the humm brand is a leader in transactions over $1,000, with strong and profitable customer growth. And according to IBISWorld’s 2020 industry report, humm is the third-largest BNPL player in Australia, commanding 17.5% market share.

At the beginning of 2020, the company also rolled out a new offering called Bundll (spot a trend?). Bundll is a BNPL service that allows customers to make purchases at any store where Mastercard is accepted.

Separate to these BNPL products, FlexiGroup offers localised credit products in the ANZ region – it operates Skye Mastercard in Australia and Q Mastercard in New Zealand. In FY20, the company’s BNPL segment contributed 27% of net income, while Australian cards and New Zealand cards represented 23% and 30%, respectively. The remaining 20% of net income was generated by the company’s commercial & leasing segment.

FY20 results

FlexiGroup is the only BNPL company that is currently profitable. Its BNPL segment reported a $4 million statutory profit in FY20, down 85% over the prior year, while the overall business achieved profit of $21.4 million, down 65%. This drop-off was largely due to a step-change in receivables impairment expenses in the wake of COVID-19.

The company finished the period with $157.5 million cash on its balance sheet and a whopping $2.3 billion of debt.

Growth strategy

Despite its long history in the BNPL space, FlexiGroup hasn’t matched the momentum seen by the likes of Afterpay and Zip. In an effort to unify its business, increase brand awareness and potentially attract a re-rating in its share price, the company recently announced it will be rebranding FlexiGroup to Humm (ASX: HUM).

As part of this strategy update, the company will also rebrand its revolving credit business (i.e. Australian and New Zealand cards) to humm90. According to chief executive Rebecca James, humm90 enables 90 days of interest-free shopping for every purchase, and up to 60 months of interest-free shopping at partner retailers.

Rounding out its BNPL product suite will be hummpro, an SME product set to launch in FY21, which will compete with the likes of Zip Business.

In what will likely please investors who are firmly focused on FlexiGroup’s BNPL opportunity, the company recently announced it will be undertaking a strategic review of its commercial & leasing business, signalling that it might be up for sale.

Openpay Group Ltd (ASX: OPY)

Founded: 2013

Listed: 2019

Headquarters: Melbourne, Australia

Where it operates: Australia, New Zealand and the UK

Active customers: 319,000 as at 30 June 2020

Active merchants: 2,162 as at 30 June 2020

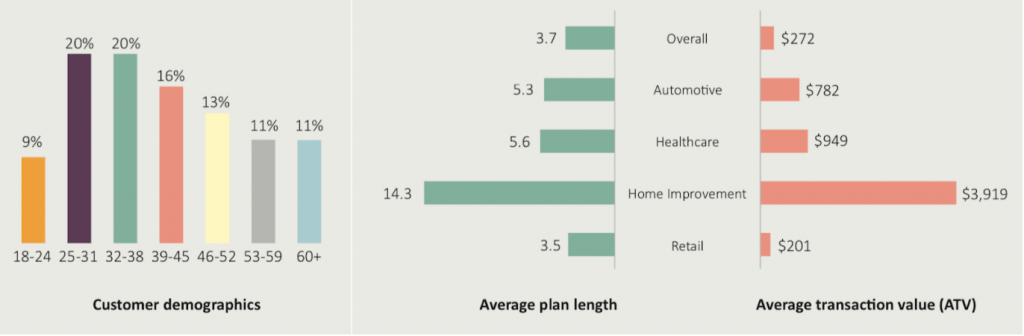

Openpay’s tagline is ‘Buy now. Pay smarter’. Consumers can choose a plan ranging from 1 to 24 months (depending on the size of the purchase) and make payments in weekly or fortnightly instalments. The company doesn’t charge interest but customers may incur plan management fees, establishment fees and late fees.

Openpay operates across four established verticals: retail, home improvement, automotive and healthcare. The latter two verticals separate Openpay from the rest of the pack. According to the company, it’s typically either the sole BNPL provider or only one of two in these verticals.

In its most recent September trading update, Openpay acknowledged new market entrants in the BNPL sector, noting they confirm the enormous potential of this new way to pay and will lead to accelerated proliferation. Commenting on product differentiation, the company said: “Whilst these new providers focus on plan durations of 6 weeks, Openpay’s finance savvy customers, who use our product as a budgeting tool, continue to be particularly attracted by our longer-term, higher-value plans across all industry verticals, including Retail.”

To flesh this out, in FY20, longer-term and higher-value plans with terms of three months and longer accounted for 91% of Openpay’s TTV. Here’s what this looks like across each of the company’s verticals:

Source: Openpay FY20 investor presentation

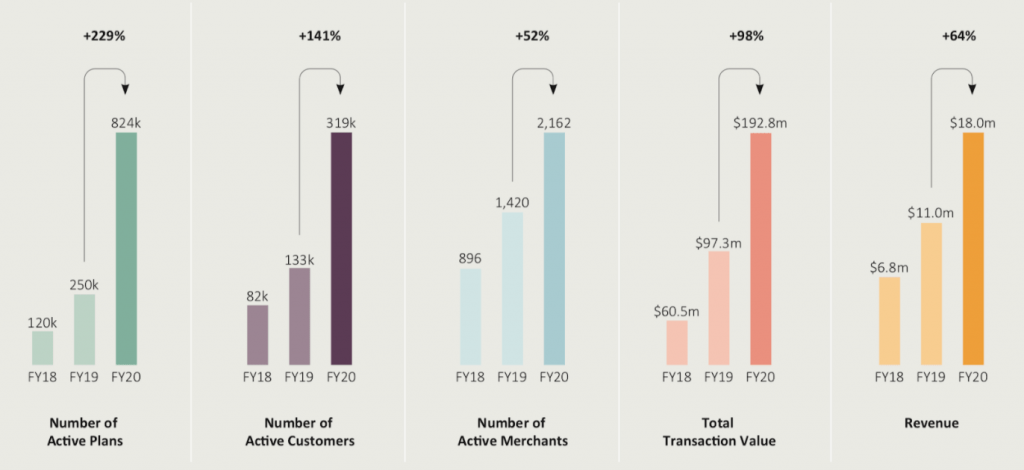

FY20 results

Openpay summarised its headline FY20 results in a neatly presented graphic so instead of listing off the results, we’ll just show you.

Source: Openpay FY20 investor presentation

These results translated to an EBITDA loss before significant items of $30.1 million, expanding from a loss of $11.5 million in FY19 but landing in line with management’s expectations.

Operating expenses jumped 115% to $48.4 million, reflecting significant investments across personnel, processes and technical platforms to support future growth.

Openpay’s receivables impairment (i.e. bad debts) expense also increased to $7.9 million or 4.1% of TTV, driven by heightened credit provisioning policies in response to COVID-19.

On the bottom line, Openpay reported a statutory net loss after tax of $35.4 million, which compares to a net loss of $14.7 million in FY19.

The company finished the year with cash and cash equivalents of $70.1 million and $37.2 million of debt.

Growth strategy

Looking ahead, Openpay is focusing on three core strategic pillars:

- A strong local market;

- A global vision; and

- Platform enrichment.

In regard to its local market, Openpay is concentrating on driving platform utilisation and repeat customers growth. The company is also looking to capitalise on its established position in existing verticals, driving revenue from exclusive agreements such as those recently signed with Bupa, ezyVet and Pentana Solutions. To top things off, Openpay plans on entering strategic partnerships (e.g. with merchants or tech platform operators) to scale.

Overseas, Openpay intends on furthering the success and momentum it has so far achieved in the UK market. The company will also seek Financial Conduct Authority (FCA) authorisation in the UK to drive further product diversity, and is exploring other markets to complement its growth.

Finally, in terms of platform enrichment, Openpay is working towards generating its first revenues from the Openpay for Business platform in FY21. Openpay for Business is a business-to-business SaaS portal that will enable businesses to manage the whole trade account process, from onboarding to invoicing, in the one system.

Earlier in the year, Openpay signed an inaugural contract with Woolworths Group Ltd (ASX: WOW), who switched on the new platform in September as part of its Woolworths at Work solution.

As part of its platform enrichment efforts, Openpay also has its sights set on two new verticals: education and memberships. In the second half of FY20, Openpay conducted a soft launch into these verticals, with a number of active merchants established in each new vertical, and is planning a hard launch in the first half of FY21.

Rounding out its growth strategy, Openpay will continue to invest in its core platform, product innovations, customer experience and advanced analytics.

Laybuy Holdings Ltd (ASX: LBY)

Founded: 2017

Listed: 2020

Headquarters: Auckland, New Zealand

Where it operates: Australia, New Zealand and the UK

Active customers: 470,000 as at 30 June 2020

Active merchants: 5,600 as at 30 June 2020

Laybuy is the ASX’s newest BNPL share, officially listing in September 2020. Laybuy considers itself as the pre-eminent BNPL provider in New Zealand, and also has a growing presence in Australia and the United Kingdom.

Laybuy operates a similar business model to Afterpay in that there are no sign-up or interest fees for customers, only a $10 late fee for missed payments.

However, the two companies differ in that Laybuy runs credit checks on prospective customers by using third-parties like Centrix and Experian. In contrast, Afterpay simply “reserves the right” to perform credit checks.

Additionally, Laybuy provides a weekly repayment schedule. Purchases are split into six equal instalments, the first of which is paid at the point of sale, and repayments are made on a weekly basis.

FY20 results

Like most Kiwi companies, Laybuy has a financial year ending 31 March.

In FY20, Laybuy reported merchant revenue of NZ$7.1 million (up 63%) and generated NZ$6.6 million from late fees (up 137%). It’s worth noting that Laybuy expects late fees to reduce as a percentage of income in each market as that market matures.

This is because, like other BNPL companies, Laybuy prevents customers with overdue payments from making further transactions on its platform. Therefore, as a market matures over time, the customer base remaining on the platform should increasingly comprise customers who are up to date on their payments (and thus, do not incur late fees).

Notably, Laybuy recognised receivables impairment expenses (i.e. bad debts) of NZ$9.2 million in FY20, up from NZ$1.7 million in the prior year. This represents 4.1% of GMV and completely wiped out the company’s full-year gross profit. Laybuy attributed the increase to its growing customer base and entry into new markets, which brings initial risk and cost until the customer base begins to mature.

After accounting for NZ$16.2 million of operating expenses, Laybuy posted a statutory net loss after tax of NZ$16.1 million for the full year.

Growth strategy

In its prospectus, Laybuy said the proceeds from its IPO would be primarily used to fund receivables growth in the UK, increase sales and marketing in the UK, and increase staffing to support growth in the UK.

Needless to say, Laybuy is very much focused on the UK market.

Along with increasing market share in its already established geographies, Laybuy plans to leverage strategic partnerships and opportunities for platform improvement.

One such partnership is a deal recently signed with Mastercard, which will enable Laybuy to issue digital cards to its customers in New Zealand. This will provide customers with an option to ‘tap and go’ at stores that accept both contactless payments and Laybuy.

Along with enhancing the in-store experience for both customers and merchants, Laybuy expects the partnership to broaden its revenue streams and deepen customer loyalty.

Additionally, Laybuy is working with EML Payments Ltd (ASX: EML) to bring a digital card to market in Australia and the UK. EML will help Laybuy roll out a smartphone-enabled digital card in Australia in the second quarter of FY21, with further plans for the UK. Customers will be able to use the card to make both in-store and online purchases.

QuickFee Ltd (ASX: QFE)

Founded: 2009

Listed: 2019

Headquarters: California, US

Where it operates: Australia and the US

As a bonus to this report, we’re throwing small-cap company QuickFee into the mix. This company flies under the radar of most investors since it’s relatively small (less than $150 million market capitalisation at the time of writing) and isn’t a traditional BNPL provider. It’s more of an ‘advice now, pay later’ company.

QuickFee provides invoicing solutions to legal practices and accounting firms. It enables clients of these firms to receive services (e.g. accounting advice) now and pay for them later. One of the biggest problems in the professional services industry is getting paid on time. This is where QuickFee comes in.

Firms can implement QuickFee’s payment gateway on their website through which clients can pay for their services via either Pay Now (upfront and in full) or Pay Later. The latter option involves QuickFee extending a loan to clients which is paid back within 3-12 months.

Although QuickFee is sometimes described as the Afterpay of the professional service space, there are some key distinctions between the two business models. Unlike most BNPL providers, QuickFee takes on minimal credit risk since professional firms guarantee the loans of their clients. What’s more, QuickFee charges interest on its loans, resulting in a wider interest ‘spread’ or margin than what is achieved by traditional BNPL providers (note: the term of a QuickFee loan ranges up to one year whereas some BNPL providers offer much shorter payment terms).

QuickFee’s value proposition to both firms and their clients is simple: timely payment and cash flow management.

QuickFee’s Pay Later solution helps a consulting firm like Pitcher Partners manage their accounts receivables, alleviating the working capital burden by simply being paid on time.

On the flip side, the client who is being billed by Pitcher Partners doesn’t have to fork out the fee all at once, which helps with cash flow management and could even mean accessing advice/services they otherwise wouldn’t have been able to afford.

FY20 results

QuickFee saw accelerated growth across most of its metrics during FY20. On the top line, revenue increased by 47% to $8.5 million. This comprised $5.7 million of interest income, up 26%, and $2.8 million of revenue from contracts, such as transaction fees and platform fees, up 123%.

Gross profit grew by 43% to $5.7 million, while the company’s reported loss extended to $3.8 million. This loss compares to a loss of $1.2 million in FY19 and was largely driven by an increase in customer acquisition expenses (up 85% as QuickFee achieved a record number of new firm sign-ups during the year) and research & development costs (up 535% as the company builds out its technology).

Excluding customer acquisition expenses, R&D and the one-off costs related to QuickFee’s IPO in July 2019, the company reported an operating profit of $185k – so the underlying business is already turning a profit. The more mature Australian business actually achieved a net profit after tax of $865k as it continues to scale.

Growth strategy

QuickFee has been operating in the Australian market for over a decade. While the company will look to consolidate its leading position in the local market, a more potent growth lever is the lucrative US market – where QuickFee has a first-mover advantage. At the end of FY20, QuickFee had 412 firms signed up in the US, including 26 of the top 100 accounting firms.

Notably, the US market is only just starting to modernise, which creates significant opportunities for QuickFee. Unlike Australia, the US is well behind other developed countries when it comes to sending invoices. In Australia, 84% of invoices are sent digitally, whereas just 32% are sent electronically in the US. In turn, the US market lacks sophistication when it comes to accepting online payments.

QuickFee also has a SaaS e-invoicing solution in the works, which it plans to roll out by the end of the year. The company believes the new solution complements the core business and should drive additional take-up of its payments solutions as digital invoices will be used (i.e. sent to clients) by professional firms and promote an ‘easy way to pay online’.

Last but not least, followers of Splitit might have noticed QuickFee was the subject of a recent ASX announcement. Under the terms of a new partnership between the two businesses, QuickFee will utilise Splitit’s pre-authorisation technology to launch an interest-free solution targeted at smaller professional firms. For example, accountants can offer clients interest-free instalments on accounting bills of, say, $2,000 ($500 today, then $500 per month, over 3 months).

As it stands, QuickFee only services medium to large firms, so this new solution widens its addressable market. The company estimates this new solution increases its target market by 650,000 accounting and law firms, although these are much smaller-value firms to QuickFee.

To learn more about QuickFee, check out this interview our investing team conducted with founder and chief executive Bruce Coombes:

Valuation

Price-sales comparison

At Rask, we’re realists. We believe that valuation of growth companies can often be more art than science. This is especially true when it comes to BNPL companies.

A very simple and rudimentary way to gauge valuation is by using the price-to-sales (P/S) ratio. This ratio looks at a company’s share price relative to its revenue – put simply, it represents the value placed on each dollar of revenue. From a pure valuation perspective, the lower the P/S multiple, the more attractive the investment.

Company | Price to sales ratio |

Afterpay | 41.29 |

Zip | 20.33 |

Sezzle | 27.03 |

Splitit | 119.87 |

FlexiGroup | 1.05 |

Openpay | 17.07 |

Laybuy | 18.34 |

Author calculations using trailing twelve month revenues to 30 June 2020 and market capitalisations on 22 September, 2020.

Splitit only booked ~$3.7 million of revenue (albeit up 220%) in the most recent half, yet commands a market capitalisation of nearly $600 million – hence the lofty P/S multiple.

On the opposite end of the spectrum, FlexiGroup recorded $450 million of income in FY20 (down 5% over the previous year), not far from its current market capitalisation of $475 million. The BNPL segment alone generated $118 million of income, which translates to a P/S multiple of around 4.

FlexiGroup’s meaningful operations outside of the BNPL sector is likely why the company hasn’t received much love from investors. While all of the pure-play ASX BNPL companies have shot the lights out in recent months, FlexiGroup shares are trading nearly 50% lower compared to pre-COVID levels.

Enterprise valuation

Another simple way to get a better understanding of valuation is to calculate the enterprise value-to-sales (EV/S) ratio, which factors in debt. As the name implies, the ratio compares a company’s enterprise value to its revenue. Enterprise value is essentially a company’s purchase price (in the event of a takeover). It is calculated by adding market capitalisation and total debt, and then subtracting cash reserves. In other words, market capitalisation + net debt.

If a company is in a net debt position, its EV/S multiple will be higher than its P/S multiple. So once again, looking at this metric in isolation, generally the lower the EV/S multiple, the more attractive the investment.

Company | Enterprise value to sales ratio |

Afterpay | 40.16 |

Zip | 27.20 |

Sezzle | 24.75 |

Splitit | 104.27 |

FlexiGroup | 5.63 |

Openpay | 15.25 |

Laybuy | 15.45 |

Author calculations using trailing twelve month revenues to 30 June 2020 and market capitalisations on 22 September, 2020.

The balance sheets of many BNPL companies are quite messy at the moment due to placements and share purchase plans that were completed after the financial year end. We’ve done our best to account for these changes.

By our calculations, Afterpay, Sezzle, Splitit, FlexiGroup, Openpay and Laybuy are all in net cash positions (i.e. they have more cash than debt on their balance sheets). As a result, each company’s EV/S multiple is lower than the corresponding P/S multiple. On the flip side, both Zip and FlexiGroup are in significant net debt positions (around $1 billion and $2 billion, respectively), which is why their EV/S ratios went in the opposite direction.

At the end of the day, the P/S and EV/S ratios require two of the same inputs (sales and market capitalisation), which is why they tell a similar story.

Of course, revenue is only valuable if, at some point, it can be translated into profit/earnings.

With BNPL companies continuing to invest for growth, it might be a while before we start to see these businesses in the black. Until then, the path to profitability, and what happens once the BNPL market matures, remain big questions that loom over the industry – and makes accurately valuing these stocks very difficult.

To learn how to value companies using ratios and models, check out Rask Education’s free valuation courses and tutorials:

- Valuation course (intermediate) – free

- Online Value Investor Program (advanced) – $799

- Video tutorial: How to calculate SaaS multiples

What next for the BNPL sector?

There’s no doubt BNPL shares have been tremendous performers to date, and it’s an industry that many investors would be kicking themselves for getting wrong (at least for now anyway).

Who would have thought a modern-day layby business, which makes slim margins and doesn’t perform credit checks, could turn the payments industry on its head?

But as evidenced by the fierce take-up of BNPL products from both consumers and merchants alike, this is a shift that’s here to stay. And the proliferation of BNPL entrants, headlined by global payments giant PayPal, only validates the lucrative market opportunity that’s at play here.

Of course, arguably a lot of this upside is reflected in current share prices. Although the market has taken its foot off the pedal recently, many of these companies are still sporting share prices more than double what was seen at the beginning of the year.

COVID-19, government stimulus considerations and overall market sentiment will likely see the share prices of these BNPL companies continue to swing wildly in the near-term. So if you’re investing in BNPL shares, strap yourself in for a bumpy ride.

For long-term investors like us at Rask, a crucial question is whether any of these BNPL companies have a defensible economic moat, or a sustainable competitive advantage, to fend off competition.

There’s certainly room for multiple players, but with PayPal throwing its hat in the ring and Klarna gobbling up market share overseas, the chances of all of these ASX players succeeding appears slim.

The key growth lever for us at Rask is understanding how these rapid-growth fintech businesses will alter their business model once they reach maturity. As evidenced by Afterpay’s success in Australia, we believe the key growth trigger for the largest BNPL providers will come from their analytics and advertising efforts, effectively providing a gateway for retailers to get exposure to tens of millions of cashed-up consumers willing to spend on hot deals.

For some BNPL providers in key markets, this shift from being a payments instalment provider to a marketing engine is already underway. It presents exciting and compelling economics for these businesses.

Two key metrics to watch closely moving forward are credit risk (i.e. gross losses or bad debts) and operating margins (i.e. net transaction margins). As long as these companies can continue to turn over their loan books and recoup greater margins than interest costs, the BNPL business model has the potential to become a powerful flywheel that prints money at every turn. Of course, this will depend on numerous factors, including interest rates, demand, margin compression, the length of loans and percentage of bad debts.

Potential risks we see on the horizon include margin compression from intense competition as the ‘value add’ for retailers/merchants bolting on another BNPL provider diminish. Regulation, especially for Australian or United Kingdom focused providers, is also a potential risk for margins. We believe it is unlikely regulators will allow the industry to largely self-regulate, as new BNPL products push the limits on payment terms and allowable balances.

This report was designed to provide a deep understanding of the BNPL sector and key players currently operating in this exciting market. If we were to start further research into the valuation, risks and opportunities today, the first two companies we’d choose would be Afterpay and QuickFee. This is not a recommendation, but we find these two businesses interesting given their market leadership – Afterpay in the BNPL market at large, and QuickFee in the niche professional services industry.

Want to read another report?

Join Rask as a FREE member now and get access to another free share idea, a comprehensive tech report straight from our premium investing subscription.

You’ll also get:

- Free online finance & investing courses on Rask Education

- Exclusive sales and discounts on our premium courses, investment subscriptions and workshops

- An occasional free research report or update

- Unlimited and uninterrupted access to Rask news on Rask Media

Already a Rask member? Go to your account page to get access!

Cathryn Goh | Investment Analyst for Rask Invest & Rask Rockets

Cathryn works on Rask Invest, our flagship investment research service. To become a member of Rask Invest and get more of Cathryn’s insights, click here to view Rask subscriptions.

Sources

- Data as of 22 September 2020

- BNPL company announcements, ASX filings & reports (see ASX website or your brokerage account)

Disclosure: At the time of writing, Cathryn owns shares in Afterpay, QuickFee, EML Payments and PayPal.

Disclaimer: This report contains general financial advice only, issued by The Rask Group Pty Ltd. The information and advice does not take into account your needs, goals or objectives, so please consider getting the advice of a licensed and trusted financial planner/adviser who can tell you if the advice/information is right for you. Investing is risky and past performance is not a guarantee of future performance. Please remember that investing in shares is risky and can result in capital loss. For more information about our advice, please find a link to our Financial Services Guide (FSG) in the footer section, below.