I — Owen Rask — believe every investment strategy and process should change when the facts change. But long-term wealth creation principles seldom do.

George Clason’s Richest Man In Babylon is still the world’s best personal finance book — it was written in 1926.

This page attempts to explain our investment philosophy at Rask, how that informs and guides our investment process, the way we think about creating wealth and building an investment portfolio, and how our model portfolios are created.

“I was once asked, at a journalism conference, how I defined my job. I said: My job is to write the exact same thing between 50 and 100 times a year in such a way that neither my editors nor my readers will ever think I am repeating myself.” – Jason Zweig

Good investing principles rarely change. Yet in the financial markets, the only constant is change. The best reporters and financial marketers cater to the change. But the wise investor understands the dangers of this transient appetite.

She or he will create robust mental models, processes and methods to avoid chasing the latest fads, fictions and fears.

Our investment philosophy is what guides us through times of extreme uncertainty. It’s our ‘why’ for investing the way we do.

As we have taught in our Value Investor Program for many years, an investment philosophy is the product of your experience and education. From many years of research, interviewing, reading, education and experience, we have come to believe that the best approach for long-term wealth creation incorporates the following fundamental principles/truths:

Capitalism works. If companies and entrepreneurs create value for society by solving problems via their companies, shareholders supporting them must also be rewarded.

The stock market is a vehicle for transferring wealth from the impatient to the patient (see Buffett annual letters)

Wealth creation can be summed up in two words: accumulate assets.

Fewer investment decisions often result in better decisions. High conviction and concentration is the best approach when you know what you are doing.

Diversification is very important for beginners, passive and index investors — including the tens of millions of Aussies & Kiwis who have better things to do than manage an investment portfolio. This is why we build your portfolio mostly with ETFs.

That said, for professionals or investors who have a decade of genuine experience, the benefits of extra diversification will rapidly diminish after 10 uncorrelated positions (see Evans & Archer). Use your Satellite to learn, grow and concentrate.

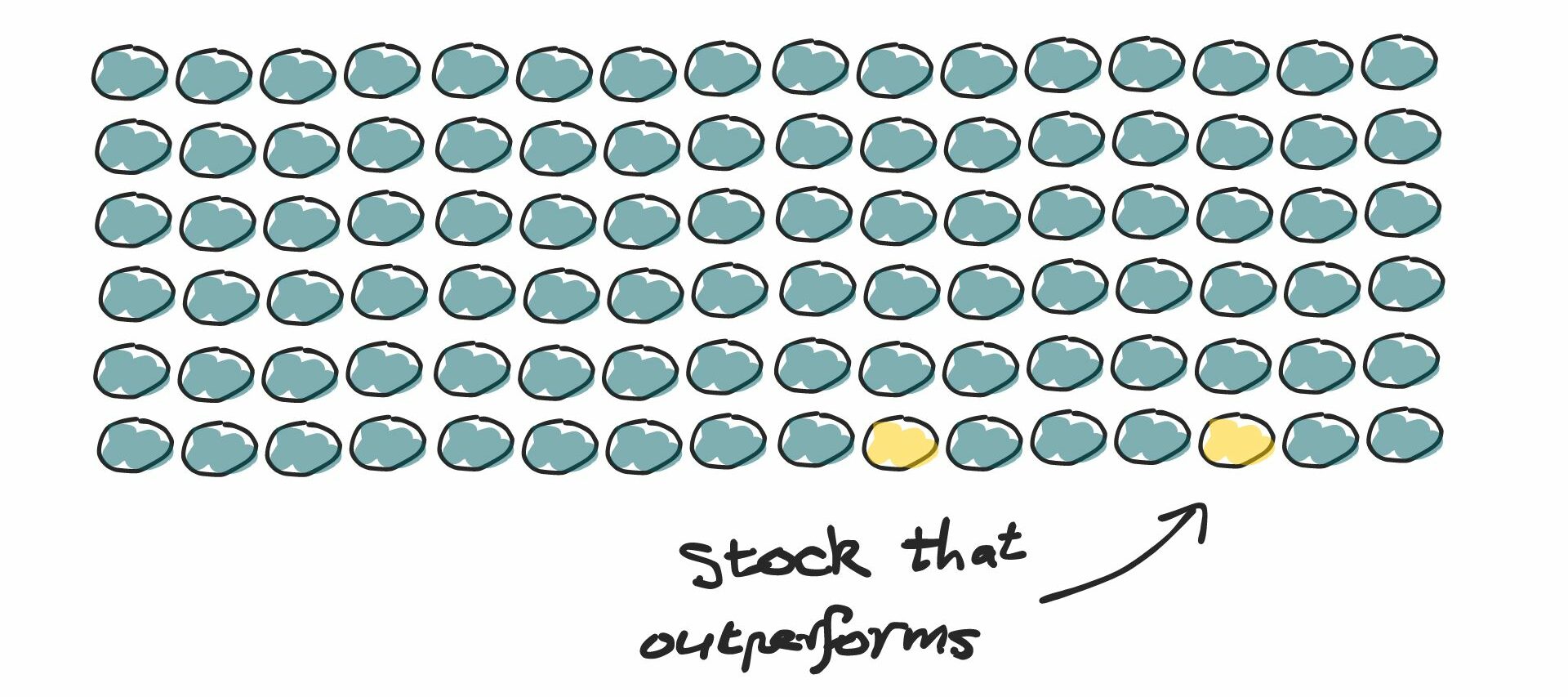

Less than 5% of companies on the stock market are responsible for all of the stock market’s wealth creation over bonds (see Professor Bessembinder). Again, carefully concentrate – or diversify broadly.

There are three commonly accepted investing ‘edges’: behaviour, analytical ability and information. Investors would be wise to focus first and foremost on their behaviour. It’s the easiest way to get better outcomes. It’ll make you a better human being.

Most people shouldn’t invest in individual shares because they lack the time, inclination and/or curiosity. Each of these is required to invest well over time.

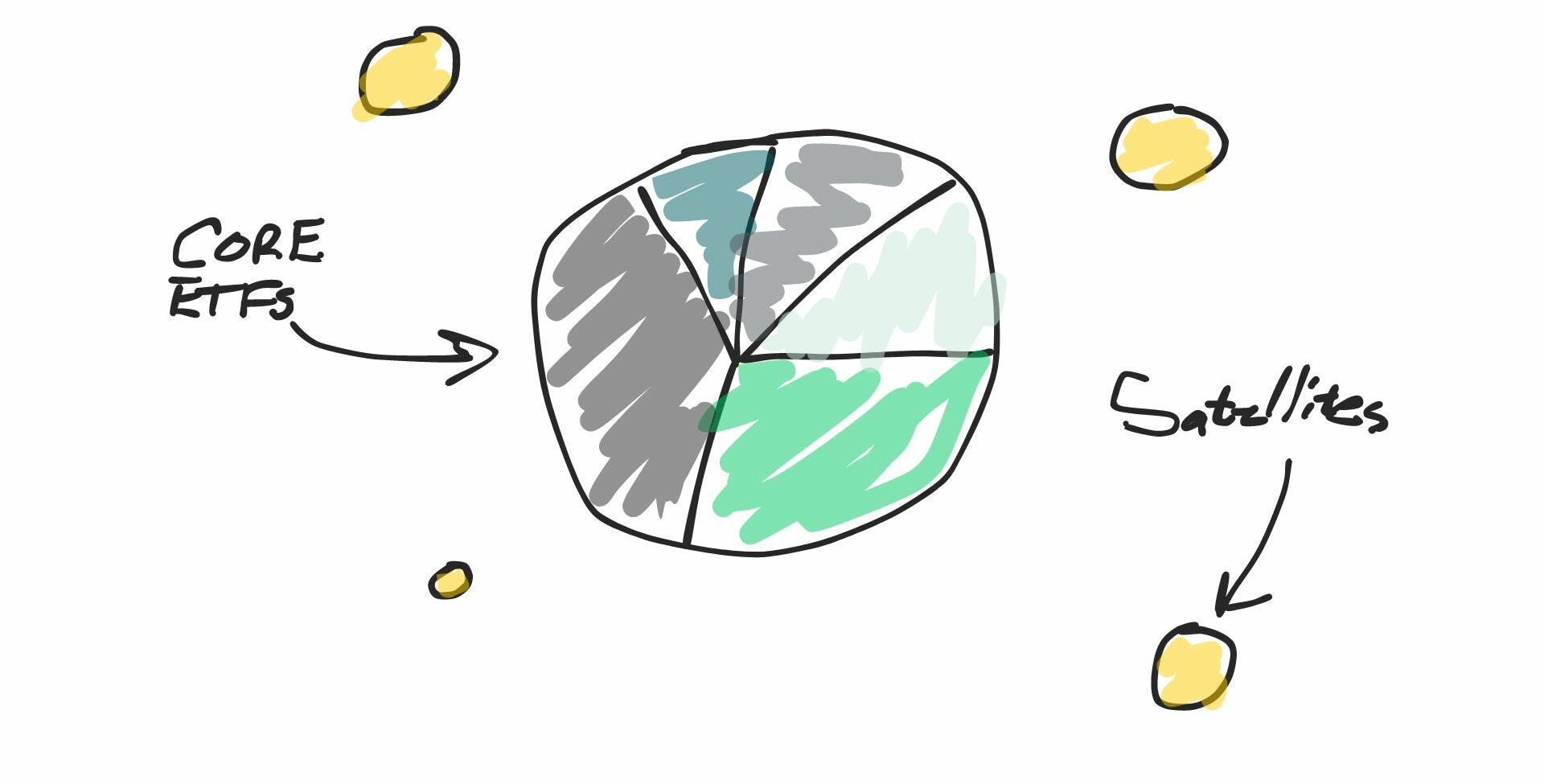

Investors do not need to choose between ‘active’ or ‘passive’ — everyone should use both in a Core & Satellite portfolio (see below).

With these 10 principles considered, we believe it is possible for private stock investors to outperform the stock market over time — but given how hard it is, everyone should use passive index funds in the Core of his or her portfolio.

In our experience, the investors who produce exceptional returns tend to have high levels of intellectual humility and curiosity, always have a Plan B (the passive Core), always minimise taxes and fees, and only ever invest with optimism for the long-term.

Investment philosophy is about principles, backed by empirical research. Investment process is the ‘how’, using agile methods.

It’s how you express your investment philosophy and actually make money from investing.

I’ve met many investors, most of them far smarter than me, who do very poorly at investing. Why? I think it’s because most of them overcomplicate it.

As a result, we believe every investor will benefit immensely from following a simple and effective framework that’s been tried and tested for decades.

At Rask, we ask our followers to consider using a ‘Core’ and ‘Satellite’ investment process for long-term wealth creation because it is simple, intuitive, limits risk, reduces envy and, of course, provides lots of long-term upside.

We have designed our three Rask Invest portfolios to reflect this framework for investing, not just in shares/equities but across other asset classes as well.

The ‘Core’ of a portfolio is the centre of every investor’s universe. It’s where most investors should begin (and end) their investment journey.

We believe the Core of a portfolio should be reserved for investments that are:

Proven (i.e. based on objective empirical evidence over decades, not weeks or months);

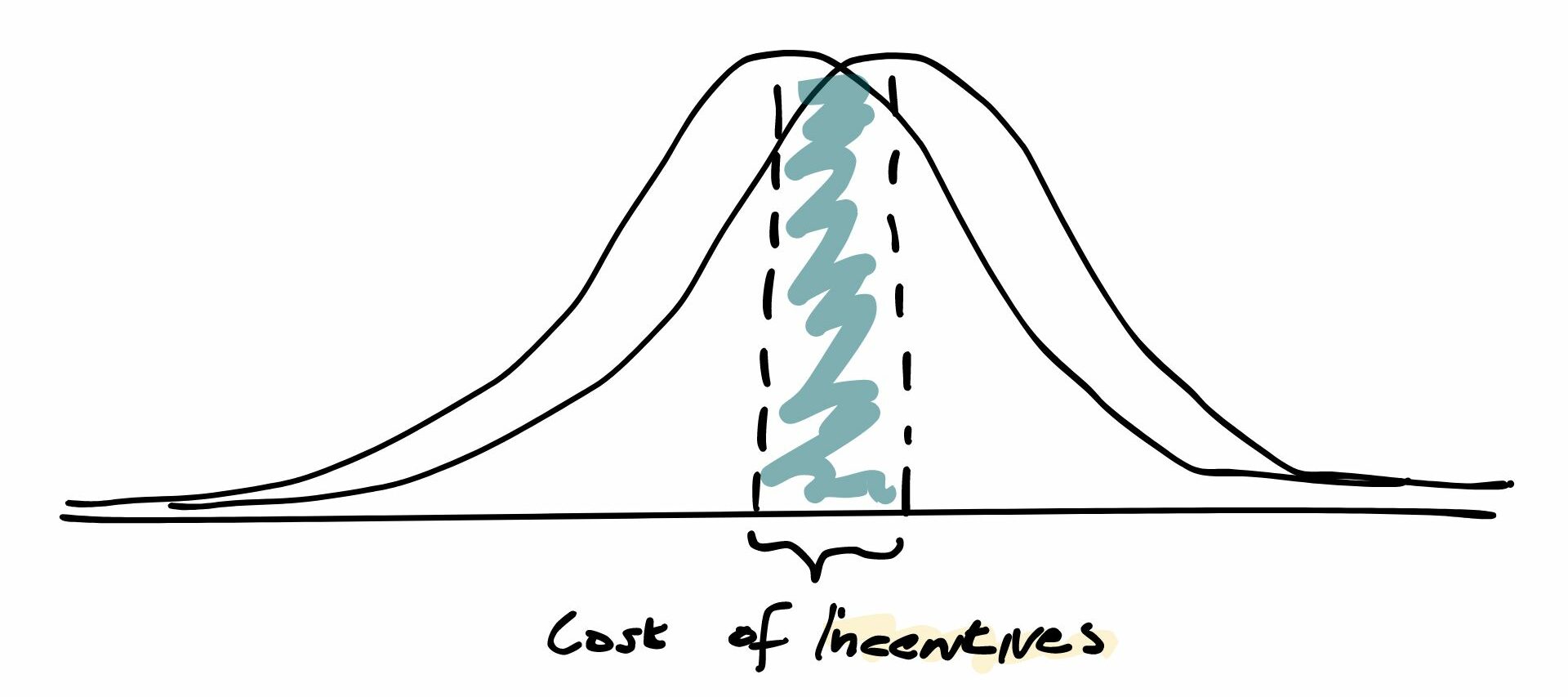

Low-cost (for maximum compounding, since fees are a big reason most investors do poorly);

Low turnover (for tax reasons, every time you buy or sell there will be a tax bill to pay — which significantly drags on your investing returns), and

Easy to understand (if you cannot sleep-at-night with your portfolio, whether it’s managed by us or you, it won’t be sustainable over the long run)

In practice, index fund ETFs, property and some managed funds go in the Core of our portfolios.

If I had $10,000 or $100,000 to invest today, I would put 90% of my money in Core positions (and I wouldn’t invest it all at once — I’d start with the smallest amounts and spread it out over months or years).

The Satellite part of a portfolio is the smaller part (or parts) that investors can reserve for their ‘active’ investing and higher risk positions.

We believe individual shares can produce great returns for focused investors. That said, a long-term time horizon (10-20+ years) and a high-conviction approach, driven by deep research and valuation work, are essential for success.

In my opinion, if the only reason you buy individual shares is to get wealthy over decades — I’m willing to bet you’ll be better off index funds, ETFs and managed funds. In my experience, investing in individual stocks in any meaningful way should only be considered by investors with extensive investing experience, time and curiosity.

To identify individual positions (i.e. shares of companies), our approach can be summarised is as follows:

The companies must have a strong and durable competitive advantage or ‘moat’

Management must be aligned, talented, transparent and consider themselves as ‘owner-operators‘ (founders and families are great)

The businesses must be within our team’s circle of competence (i.e. what we can understand). Given our expertise lies in the technology, finance, software and industrial sectors, we almost never venture outside of these industries. Fortunately for us, the companies in these industries can be extremely profitable.

The business must operate in a structurally growing and increasingly important sector, market or geography. The total addressable market (TAM) is very important when we are aiming to invest for 5-10 years or more.

The shares/business must be reasonably valued. Note “reasonably”. We will often use the standard valuation modelling tools, such as discounted cash flow (DCF) analysis, internal rate of return (IRR), comparables and multiples, and sum-of-the-parts. All of which we have taught or educated thousands of investors to use.

Additional notes

At a much deeper level, here’s what we will do day-to-day: our analyst team will conduct full qualitative and quantitative reviews, scoring companies and funds out of 100, using our in-depth proprietary framework. For example, we have a well-rounded quantitative and qualitative framework that seeks to score companies and funds (adding, or detracting) out of 100.

An analyst leads this, but then we peer review and debate these as a team. The Chief Investment Officer has the final say on whether a position is added to the models and has the responsibility of seeking feedback from the investment committee before a trade is ordered.

All important elements of our research are surfaced and presented to our investors, demonstrating our knowledge and the depth of our research — regardless of whether the investment will be made in our portfolios. For example, let’s say we review the ASX’s top dividend shares for harvesting franking credits for an income-focused portfolio. We might identify our top two ‘expressions’ (see below) but ultimately believe it is not the opportune time for us to invest. So we will securely store that research in our cloud-based drives and share a comprehensive write-up of what we found with our end-investors. This builds accountability, transparency and flexibility.

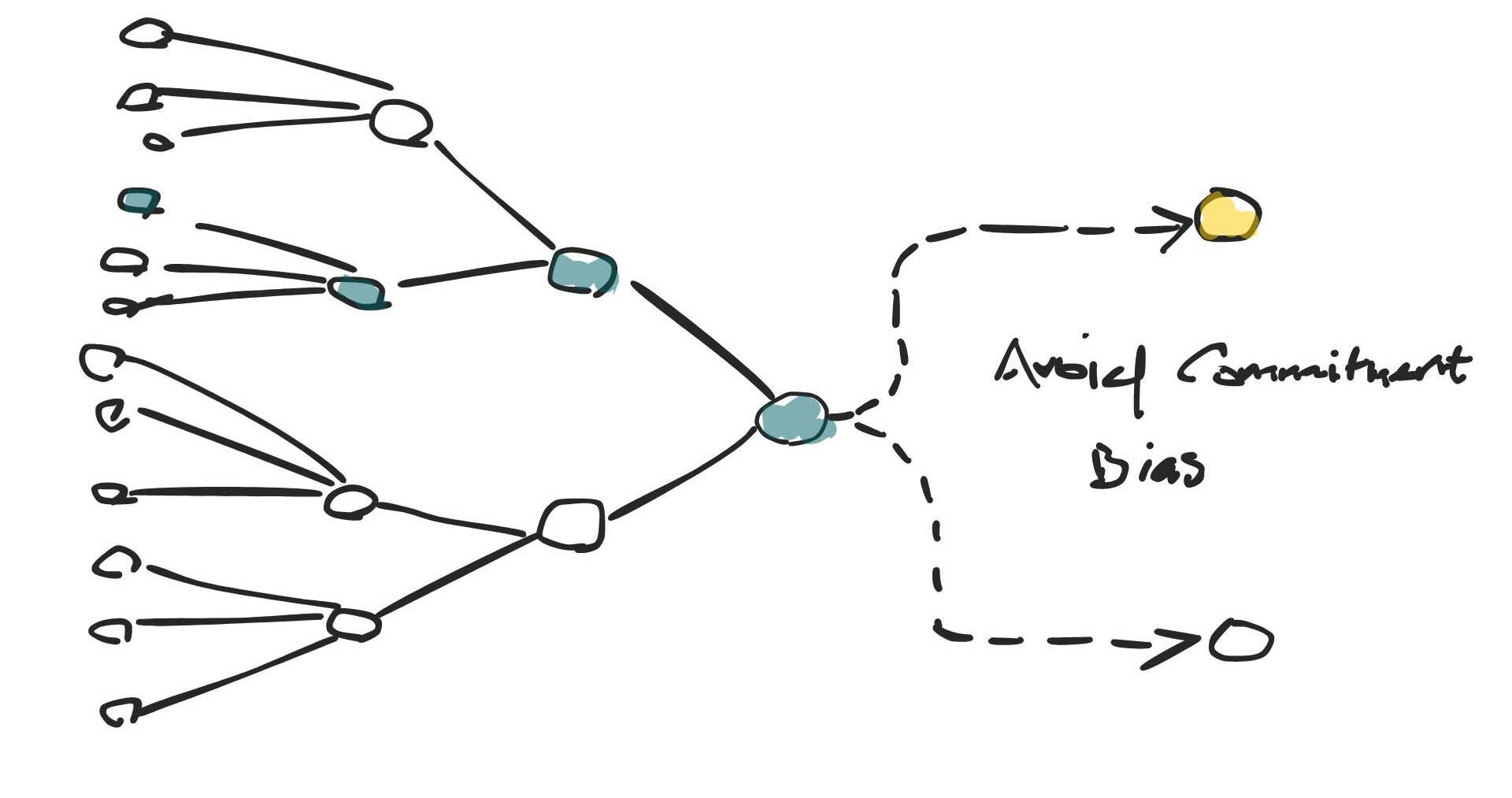

Our process day-to-day also has a logical ‘flow’, following the same principles above, but it will vary depending on which of the three investment types we are considering: shares, actively funds, or index funds. However, our team will also look ‘laterally’ for what we call the “best expression”. For example, within an asset class, we won’t simply compare blue chip share #1 against blue-chip share #2. Or ETF #1 against ETF #2.

We will seek to find the ‘best expression’ of every trade: whether it’s a diversified index fund, dividend ETF, thematic or sector exposure, LIC, REIT or active fund. For example, if we set out searching for tax effective income from ASX shares, we may end up concluding that the best expression of that trade (tax effective income) is actually to use an index fund. Or a LIC. Or REIT. This ensures we have a process roadblock before every portfolio decision, requiring us to stop, reflect and avoid the tunnel vision which often results in investors being blindsided. It’s also a great way for us to continually act in the best interests of our community.

Owen “Rask” Raszkiewicz

Chief Investment Officer & Founder

If you would prefer to dig deeper into our philosophy and process, the following resources should help:

The information on this website is general financial advice only. That means, the advice does not take into account your objectives, financial situation or needs. Because of that, you should consider if the advice is appropriate to you and your needs, before acting on the information. In addition, you should obtain and read the product disclosure statement (PDS) before making a decision to acquire a financial product. If you don’t know what your needs are, you should consult a trusted and licensed financial adviser who can provide you with personal financial product advice. Please read our Terms & Conditions and Financial Services Guide before using this website.