Please note: this explainer comes directly from our ETF investing course — which you can access (for free) by clicking here.

Investors buy and sell ETFs the same way they would buy a share on the sharemarket.

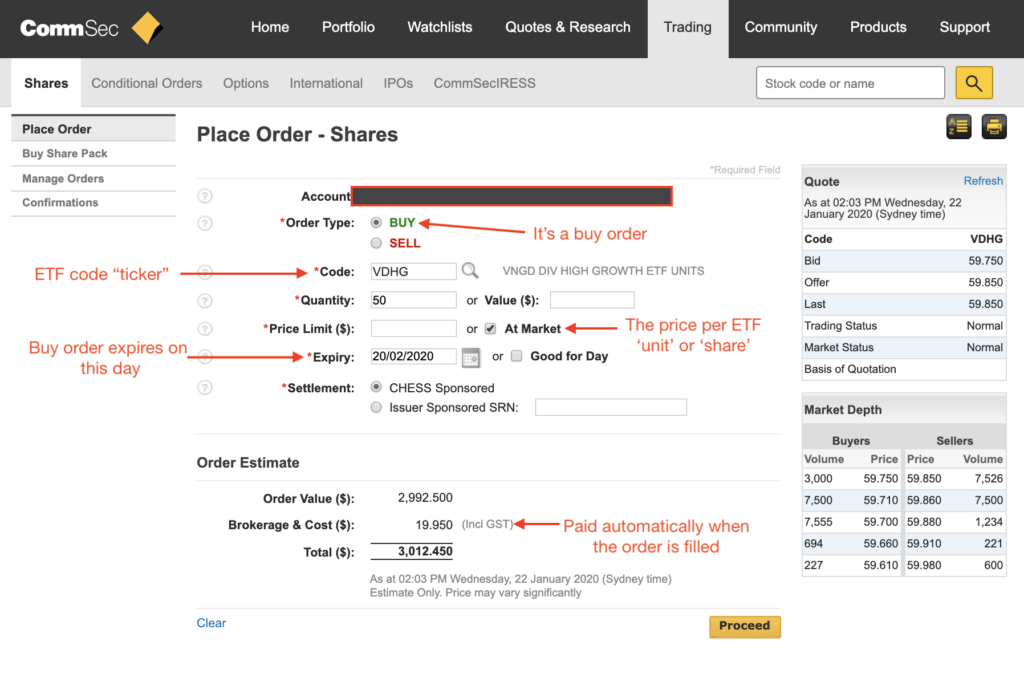

Minimum orders of $500 can be placed on the ASX during trading hours (10am – 4pm AEST) through a share brokerage account.

If you’re new to investing, you’ll need to apply for one of these ‘brokerage’ accounts.

Think of a brokerage account as the love child of eBay and online banking. Once you apply, you fund the brokerage account and then click “buy” on the share or ETF that you want to own.

Many of Australia’s major banks offer stock brokerage for both Australian and international share investing. But they’re not the only ones doing it.

You can head on over to Canstar or another comparison website for details, keeping in mind some of the following:

- Brokerage fees – paid/deducted automatically when you buy or sell (e.g. $10)

- Account fees – can be monthly or yearly (tip: some don’t have them)

- Useability

- Fees for “extras” like market data or charting

- Responsiveness of customer service teams (this can be important during set-up)

- Option to trade international shares (most brokers only do Aussie shares, not US companies)

Disclaimer: As always, before you sign up to a brokerage account, you must read the product disclosure statement (PDS) and financial services guide (FSG) for the company, paying particular attention to the “risks” sections.

I’ve got a brokerage account, now what do I do?

Got your brokerage account?

Great!

Now that you’ve opened it and transferred money into it, you’re ready to buy an ETF. Here’s how the process works…

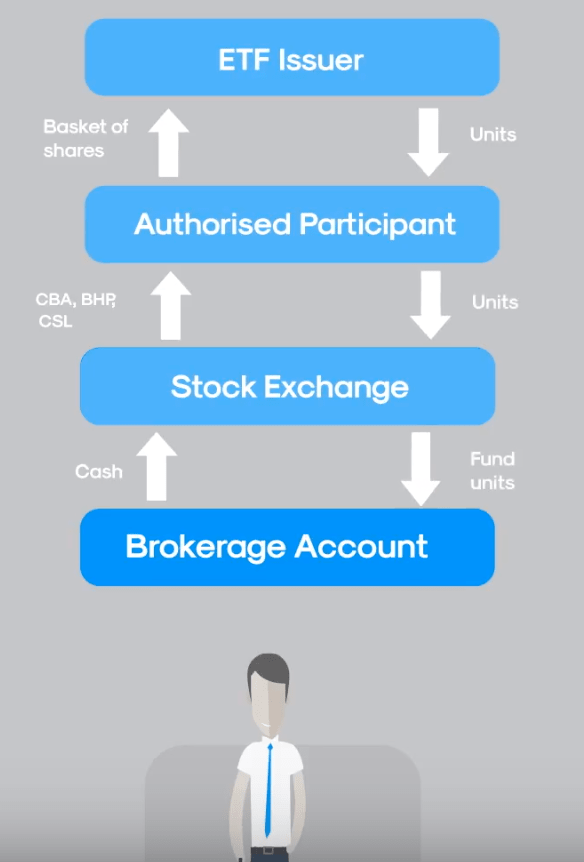

When you invest your money in an ETF (e.g. when you click ‘buy’ in your share brokerage account), there are companies on the other side of your order that hand you something called ‘units’.

These units are filed in your name and sit inside your share brokerage account.

Your ‘units’ represent what your investment is worth. For example, if you buy an ETF at a price of $10 per unit and it goes up to $11, you have made $1 per unit — or 10%. Nice work!

The finance company which operates the ETF is called an ‘issuer’ or ‘provider’. They will take your money and invest it in a collection of shares or other types of investments.

For example, an ASX 200 ETF will have 200 shares inside its portfolio (or basket). When you invest $500 in this ETF, your money is deducted from your share brokerage account and invested in all 200 shares inside the basket.

Meaning, with your $500 you get a tiny slice of each of the 200 largest companies on the ASX.

However, instead of seeing a fraction of each share in your brokerage account, you’ll see a unit price. This price roughly equals the value of each of the 200 slices.

OMG. OMG. OMG. I want to sell!

Do you want to sell your ETF units?

Sure thing. Here’s how it works…

When you decide to sell your ETF units, the opposite thing happens.

The ETF issuer will sell your slice of the 200 shares inside the ETF and give you your money back — to the value of whatever they’re currently worth. This money will usually appear in your brokerage account within three days after your sell order has been processed.

Although the minimum order to buy a share or ETF through your brokerage account is $500, this rule doesn’t apply when you decide to sell. For example, you could sell $150 of your ETF if that’s all it was worth.

Usually the only restriction is that the value of whatever you are selling (the ETF) has to cover the brokerage costs (e.g. $10-$20).

For an overview on what I’ve just covered, check out the video above — or take our free ETF investing course.

If you’re still unsure, continue reading the other material on the Rask ETF members page.

Happy investing!