Episode transcript: click here

About this episode:

Have you ever wanted to be your own Sherlock Holmes and start investigating companies?

Welcome to Shares Month on The Australian Finance Podcast! This month is all about how to analyse stocks like a pro investment analyst.

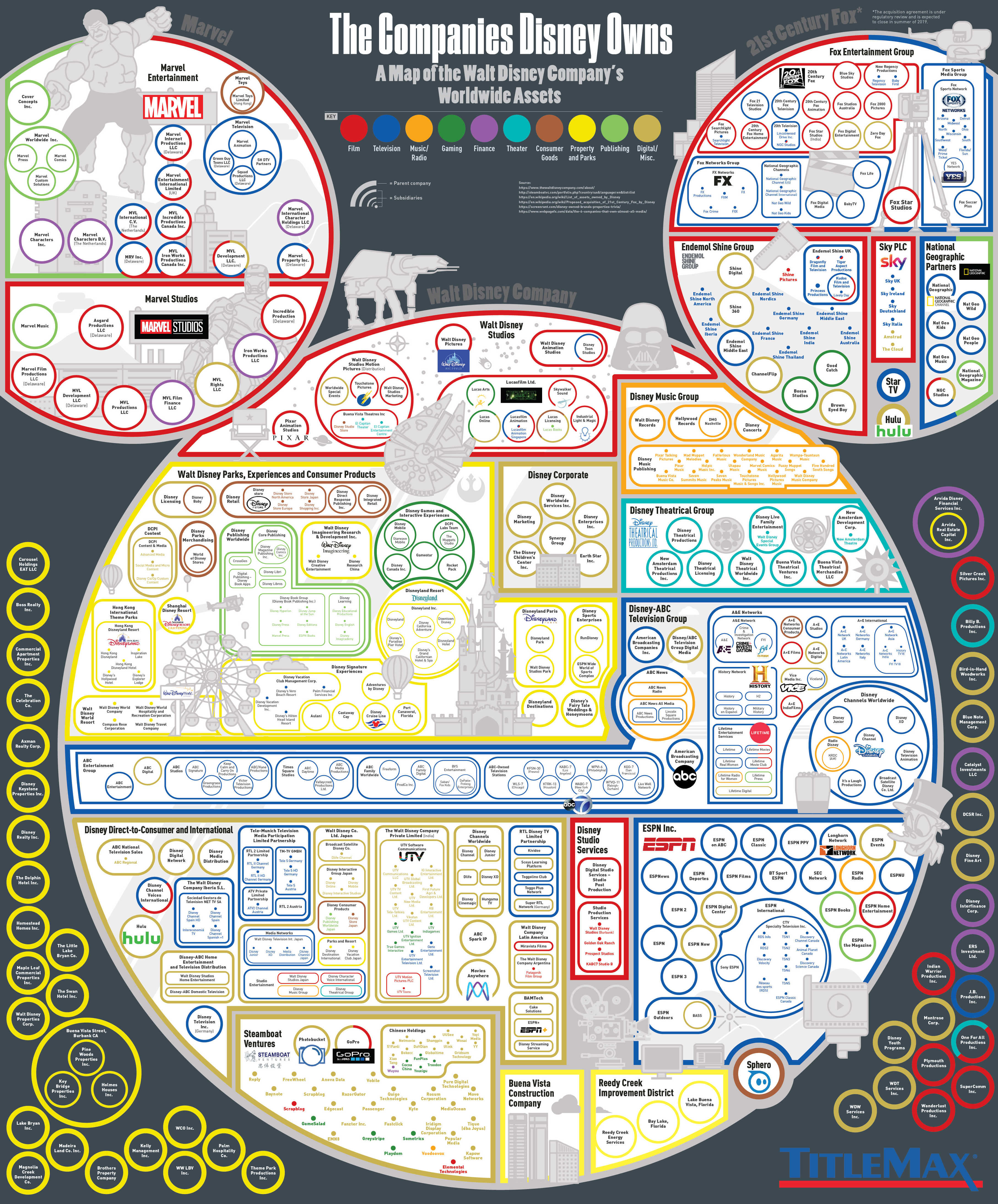

Today’s episode applies our 5-part investing checklist (that we introduced you to last week), to a company that we all know and love, The Walt Disney Company (NYSE: DIS).

It’s Cathryn Goh’s debut on the show, so Kate throws her in the deep end in analysing Disney! We chat about Disney’s revenue sources, the size of its moat, comparable companies, management, and more.

If you’ve listened to our earlier share investing episodes, dive straight into the checklist around 8 minutes.

Send your share investing questions to [email protected] with the subject line SHARES MONTH, and we’ll include them in our share analyst Q&A episode later this month.

Take our free financial education courses on Rask Education and join our FB community.

At the time of recording, Kate owns shares in Disney, EML Payments, Spotify & Apple. Cathryn owns shares in EML Payments, Xero and Afterpay. Owen, Kate, Cathryn or The Rask Group Pty Ltd do NOT receive anything for mentioning Super funds, products, shares, bank accounts, etc.

Resources:

Tune into Part 1 of Shares Month, where we introduce Owen’s 5-part share investing checklist here.

- Rask Education Courses: ETFs, Shares & Share Valuation

- Every Company Disney Owns: A Map of Disney’s Worldwide Assets

- Access industry reports: IBISWorld, Gartner & Statista

- Yahoo Finance!

- How to buy and invest in US stocks (from Australia)

- Ep. 9. Investing in Shares in Australia | Rask Australia

- What Is The Price-Earnings Ratio (P/E)? (Rask Education Tutorial)

Developed by TitleMax.com

Rask Education money & finance courses

Please forgive me, I couldn’t help but plug our 5-star (and free) financial education courses in here. I’ve linked a few of my favourites below if you’re keen on taking control of your time and money.

- Financial Independence, Retire Early (FIRE) Mega Course

- Beginner Shares Online Course

- Money & Budgeting: The Complete Guide

- Beginner ETF Investing Course

[ls_content_block id=”27363″ para=”paragraphs”]