Jupiter targets an average return of 7.5%+ per year over 10-15 years by investing 90% of your portfolio in growth assets, with some (10%) defensive assets.

The construction of Jupiter is such that it may be considered suitable for accumulators (i.e. people still working, between 18 and ~60) who are seeking a ‘complete’ Core portfolio. Depending the investors needs and goals, it should be blended with a healthy cash holding (outside the portfolio), as this strategy has an ultra-long-term focus (see below). It could also be used as part of a wider strategy depending on the investor’s particular circumstances and goals.

Jupiter suitable for Investors with a very long investment timeframe (i.e. 15 years). However, we believe Jupiter could be blended with a solid savings account, term deposit or offset account cash holding (i.e. 12 months’ worth of living expenses) and, therefore, be suitable for investors with a slightly shorter time horizon (i.e. 7+ years).

Investors seeking high levels of capital growth with some income over the very long term. It suits investors who are prepared to accept very high levels of risk and volatility in returns year to year.

| Security Name | Code | Weighting |

|---|---|---|

| Betashares Australian High Interest Cash ETF | AAA | 3.00% |

| VanEck MSCI Multifactor Emerging Markets Eq ETF | EMKT | 10.00% |

| iShares Core Composite Bond ETF | IAF | 5.00% |

| iShares S&P 500 (AUD Hedged) ETF | IHVV | 10.00% |

| iShares S&P 500 AUD ETF | IVV | 30.00% |

| Vanguard Australian Shares Index ETF | VAS | 40.00% |

| CASH | 2.00% |

| Holding | Exposure |

|---|---|

| iShares Core S&P 500 ETF | 39.96% |

| USD/AUD Purchased | 21.83% |

| BHP Group Ltd | 3.68% |

| Commonwealth Bank of Australia | 3.58% |

| CSL Ltd | 2.18% |

| National Australia Bank Ltd | 1.82% |

| Westpac Banking Corp | 1.73% |

| ANZ Group Holdings Ltd | 1.44% |

| Macquarie Group Ltd | 1.30% |

| Wesfarmers Ltd | 1.26% |

| Goodman Group | 1.02% |

| Taiwan Semiconductor Manufacturing Co Ltd | 0.81% |

| Rio Tinto Ltd | 0.76% |

| Australia (Commonwealth of) 2.75% | 0.35% |

| HCL Technologies Ltd | 0.27% |

| Quanta Computer Inc | 0.27% |

| Australia (Commonwealth of) 3.25% | 0.26% |

| Tencent Holdings Ltd | 0.25% |

| Power Grid Corp Of India Ltd | 0.22% |

| ASE Technology Holding Co Ltd | 0.21% |

The Jupiter strategy targets an average return of 7.5%+ per year over 10+ years by investing 90% of your portfolio in growth assets, such as Australian and international shares, with some defensive assets, like bonds or fixed income, and alternative assets, like gold; to protect your money and give us some dry powder to reinvest when markets get choppy.

This strategy was designed for investors who are, like us, very long-term focused, want to grow their wealth sustainably over time, and are prepared to accept high volatility and high risks in order to pursue long-term investment outcomes.

This strategy invests in a mixture of Australian and international shares, alternative assets, cash, and fixed income, blended for growth and income. More than half of the portfolio will be passive, exchange-traded funds (ETFs), offering diversification, transparency, and (typically) low costs. Such holdings form the bedrock for exposure to markets. In addition, after rigorous research, our team will tilt the portfolio to talented active funds managers (e.g. small-cap managers), direct shares, LICs or alternative assets. Our team seeks exposures that are not perfectly correlated to traditional assets, like Australian shares, and towards alternative growth assets which are not available as a traditional index fund. We believe a blend of low-cost market exposure (“beta”) with a willingness to back capital allocators (“active”) can result in strong risk-adjusted returns for our investors.

5 – 20

ASX listed passive ETFs, active ETFs, LICs, REITs and shares.

0.55% plus ETF fees of 0.16% = Total 0.71% (inc GST)

$20,000

What is the minimum % exposure to:

What is the maximum % exposure to:

Under 25%

10+ years

0.09% – 0.30% p.a. Our portfolios use Exchange Traded Funds (ETFs) and these fees are charged by third party ETF providers.

The greater of $4.40 per trade or 0.044% of the value of the trade paid entirely to 3rd party broker

They say there are no free lunches in investing. I disagree.

I believe that a Core portfolio built from low-cost, diversified index fund ETFs is the best bang for our buck we’ll find anywhere.

I don’t have exact numbers on it but I believe the invention of the index fund, which are now made available inside some ETFs, is the single greatest disruptor the finance industry has ever seen.

Since 1976, when John Bogle launched Vanguard’s first index fund, index funds have resulted in billions of dollars going back to investors that might otherwise be paid in fees to Wall Street.

One by one, the disruption caused by the trend toward index funds has resulted in active investors, Superannuation funds, financial advisers and wealth management platforms (e.g. brokers) also lowering their fees. For example, Rask Core’s super-low membership fee is a direct result of competition for lower fees. This trend was started by Bogle.

On a $1 million portfolio, the difference between a 1% management fee and the fees for our chosen portfolios is clear: a 1% fee would be $10,000 going back to fund managers; the Rask balanced portfolio option (Martian) would cost $2,480 per year — a 75% reduction in fees!

Over in our Satellite section, you will find a list of companies/stocks (and other types of investments) that I find fascinating. In times gone by, most people would start with stock picking — because it was really the only option.

However, as time has gone by, research paper after research paper has suggested that a long-term portfolio’s returns are best explained by an investor’s Core portfolio. Specifically, studies show that taking risk by staying invested and the overall mix between growth (e.g. shares) and defence (e.g. bonds and cash) will determine whether you make money or not — not the stock picks you make.

Big investment firms often quote studies, like the one by Brinson, Hood & Singer (1991) which showed that around 91% of a portfolio’s return is explained by which markets you invest in (e.g. shares or bonds) and only 7% is explained by which individual stocks you pick. It’s worth noting some critiques say it might be closer to 50%.

Nonetheless, I think these results (together with the other stuff I’m about to explain) reveal to us some glaringly obvious facts about investing. Specifically, they tell us it makes more sense to:

Most investors go about it the wrong way. They spend the majority of their time trying to find “cheap stocks” when most of the return will likely come from simple decisions like ‘60% in stocks will do me’.

I still love finding undervalued stocks and learning about businesses. But I want to get the record straight — it’s great fun, but it probably won’t be the thing that makes you wealthy.

Professor Bessembinger shows that depending on the market you fish in, between 1.5% and 5% of stocks do better than bonds. Put another way, if you do decide to pick individual stocks, it’s important to accept that maybe only 1/20 will do well. So when you find them, hold on! Or instead of trying to use a rod & reel, just cast a wide net (index fund).

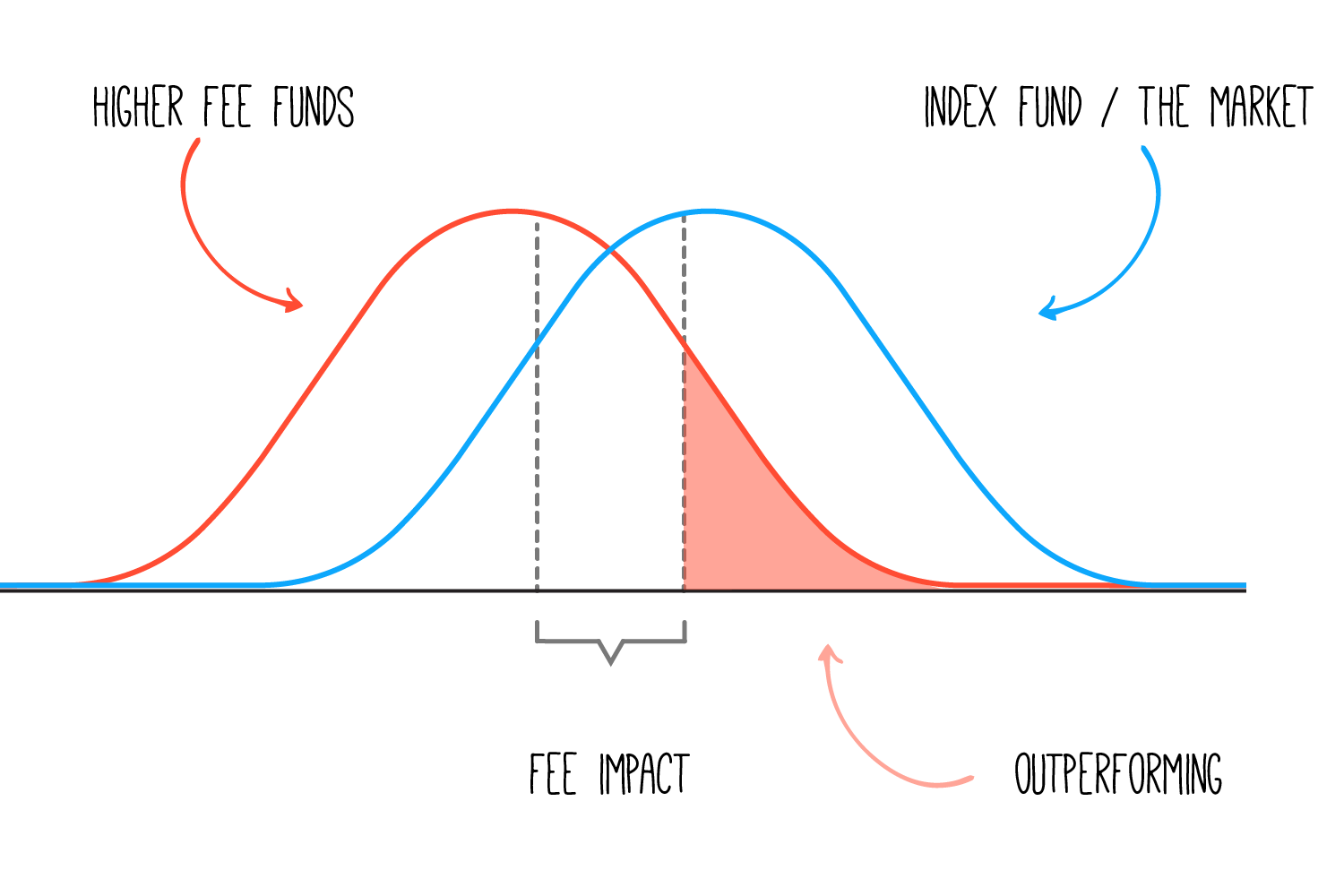

Amongst professional investors, S&P SPIVA research shows that most professional fund managers do worse than their index fund equivalent. The longer the survey period, the worse the results become. Put another way, the longer the time horizon the better index funds look!

| Geography | 5 years | 10 years | 15 years |

| Australia | 74% | 77% | 83% |

| USA | 84% | 90% | 89% |

Finally, diversification is another reason why index fund ETFs probably make more sense for the Core of a portfolio than individual stocks, costly investment properties, and many other types of investments.

It’s been shown that ~30 random individual investments is enough to capture a lot of the benefits of diversification. And if you know what you’re doing (e.g. a professional investor), 15 uncorrelated investments is probably enough. This is why stock brokers used to say “it’s a race to 30”. Meaning every investor should have at least 30 stocks to be diversified.

(Side note: anyone who has owned 30 stocks will know how difficult it can be to ‘keep up’ with all 30 companies.)

For an index fund investor, instant diversification across stocks is achieved with one investment. For example, if you buy into the Vanguard Australian Shares Index ETF (ASX: VAS), which has ~300 companies, you’re going to get some miners, some bank shares, some technology shares, etc. If one of those sectors (e.g. banking) does poorly, you’ll be partly insulated because the rest of the portfolio might not be exposed to exactly the same risks. Throw in bond ETFs, cash ETFs and global shares ETFs, and you can get very well diversified with just a few ETFs in your portfolio.

It’s worth spending a few moments talking about what drives index returns. Personally, I believe risk is what drives the overall stock market. That is, taking calculated risks is what enables some people to become wealthier than others.

Take a look at the following table, which reveals the yearly returns over… wait for it… 52 years! You can see that shares beat bonds and cash. I reckon they’d also beat property, but I didn’t have the property dataset for 50 years.

| Market | Yearly return (average) |

| Australian shares | 9.4% |

| Global shares | 9.7% |

| US shares | 11.5% |

| Australian bonds | 7.5% |

| Cash | 7.4% |

Source: Vanguard index charts, as of June 2022 (the link opens in a new tab).

If we zoom out even further to, say, 100+ years of stock market history, we will see that the Australian share market has returned an average of ~13% over the 122 years, to June 2022 — making it the best stock market in the world.

There are a few key reasons for our prosperity but one that keeps emerging in my conversations and research is simple: we’re a stable democracy with strong regulation.

Likewise, in the United States, one of the best-performing stock markets since the 1900s, we’ve seen investors rewarded time and again. Again, we see a strong nation with a capitalistic democracy (though polarising) that champions economics and property rights. According to data going back to 1871, the top 500 companies in the USA (represented by the S&P 500 index fund ETF, or IVV) have grown their profits, on average, by 6.14% per year.

Importantly, today’s S&P 500 is not the same 500 companies as in 1871 (there was a time when 50% of company profits were from railroads!). And some years were bloody terrible — in 2008, for example, corporate profits went backward 77%. And from 1917 to 1921 (5 years) profits went backwards 29%, 36%, 18%, 16% and then 59% (the next year they jumped 144%).

But here’s the rub, many years were great! 8 years saw corporate profits rise greater than 50%! And 59% of years were positive. Index investing is about averages.

History has proven that, overall, the stock market is the single best place to invest in the long run. And I believe it’s because businesses create more value for society, and this is slowly but surely represented by steadily increasing profits. After all, if your business isn’t reporting a profit — it’s probably not creating enough value (so it dies, and something takes its place!).

The data here also leads me to prefer to invest in markets where there are strong democracies and a stable legal system (e.g. one that respects property rights and fosters innovation). Such as the USA and Australia.

Choosing the best ETFs is only one part of investing in ETFs. The way we ‘mix’ ETFs together, known as portfolio construction, is what’s important.

When I put these portfolios together, I took into account:

If you’re a completely new investor, be sure to consider the Vanguard diversified ETFs before the Rask Core portfolios. They could be easier for you to start.

Picking a Rask Core ETF portfolio to follow comes down to two things:

With a low-cost and diversified Core portfolio in place, I reckon you’re 90% of the way towards using the greatest compounding tool (the stock market) to your long-term financial advantage.

With low costs, a healthy amount of diversification, income and growth focus, I think we’re tilting the odds of long-term investment success firmly in our favour with the Rask Core portfolios.

If you have any questions, be sure to pop them into the Rask Core Community.