Absolute basics: inside a brokerage account & how to buy shares

If you’re new to investing you’ll need to get a broker to buy shares… but which one do you choose?

In this brief article I’ll attempt to outline a few options. As always, be sure to read the Terms, Financial Services Guide (FSG) and speak to your adviser before acting on the information.

🖨 Click here to download a PDF version of the transcript “Choosing a share broker” from The Australian Finance Podcast. The episode is embedded below.

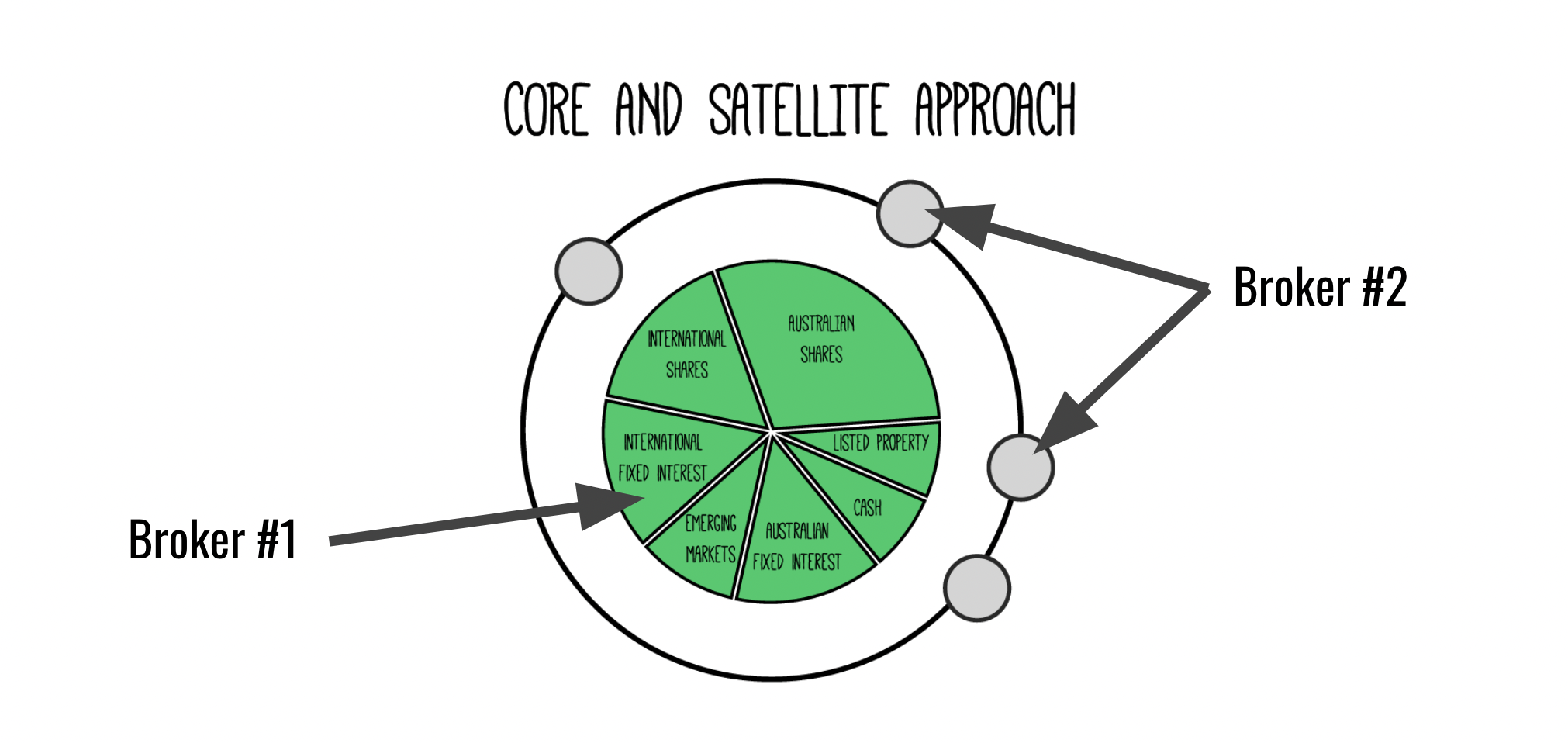

Core & Satellite

As you know, I’m a big advocate of the Core & Satellite approach to investing. The Core of your portfolio is the most important part and it should be diversified across Australian shares ETFs, global shares ETFs and Australian bond ETFs. And then maybe you could consider some cash or gold.

💡 If you’re stuck, just remember this: the Core is boring. It should be low-cost and diversified. If I was starting out with $20,000 today, I’d start with my Core by spending all of my $20,000 building out my diversified Core portfolio.

After I had been investing for a couple of years, or if I was keen to try my hand at higher-risk investing (e.g. individual shares) I’d begin building out my Satellite portfolio. But it’s not essential.

| Core | Satellite |

| Low-cost ETFs (e.g. VAS, IAF) | Thematic ETFs (e.g. FANG, IXJ) |

| Blue chip shares (e.g. CBA) | Small & mid cap shares (e.g. Xero) |

| Some LICs (e.g. AFIC) | Higher risk, higher cost investments |

💡 I think it’s smart to separate your Core & Satellite investments into separate brokerage accounts. That way you can pick the best brokerage account for each ‘portfolio’.

The brokers Rask members use

You might remember taking our onboarding survey when you joined us.

The chart below updates automatically every time a member joins our community. It maps the responses to our question on which brokerage you use. Note: you can re-take the survey by clicking the link above.

Core positions

For my Core portfolio, I like Pearler (the link opens in a new tab).

⚠️ You should know Pearler is a long-term sponsor on Rask’s Australian Finance Podcast. This is part of a long-term partnership with Rask, with the fee set in advance. We do not make any type of variable or affiliate style income or benefits by me talking about their platform.

The reasons I like Pearler can be summarised by these points:

- The entire platform is designed for long-term, low-cost investing. Unlike nearly every brokerage account I can think of, Pearler defaults to showing you the 10-year price performance chart when you search for an investment. Why does this matter? It tells me they genuinely want you to focus on the long-term. That’s unique.

- Pricing is transparent. $6.50 per ASX trade is cheap, and they’re upfront about their US share trading costs. Click here to view prices.

- They offer micro trading. If you’re just starting out with a few hundred dollars, micro-investing has its benefits. Just keep an eye on fees.

- The platform is built for dollar-cost averaging. We know DCA-ing into low-cost ETFs is a superb strategy for long-term wealth creation. Pearler has features like ‘auto-invest’ and makes it easy to automate and rebalance a portfolio.

- The user experience is easy peasy. Unlike many brokerage accounts, Pearler prides itself on having fewer widgets you really don’t need. One Rask member said she was surprised how basic Pearler was. I like basic and low cost for my Core.

- CHESS sponsored. ASX trades on Pearler are CHESS sponsored, meaning you are the unique holder of the shares or ETFs you buy. This Rask Media guide to CHESS holdings explains why we think that’s important.

⚠️ Note: you should always read the Terms & Financial Services Guide (FSG) before signing up to a broker, and always consult your financial adviser. Why? A platform like Pearler is new and still finding its feet. Click here to read Pearler’s FSG.

Click here and Use the ‘Rask’ coupon code on Pearler — you’ll get free trade credit when you sign up.

Satellite positions

For Tactical or Satellite positions, I want a broker that provides access to ASX and global shares in one platform, offers company financial data and company announcements built in. For that, my two choices are Stake and Selfwealth. Commsec would be in third.

⚠️ You should know Selfwealth is a long-term sponsor on Rask’s Australian Investors Podcast. This is part of a long-term partnership, with the fee set in advance. We do not make any type of variable or affiliate style income or benefits from me talking about their platform.

Here are the reasons I’d consider Stake and Selfwealth:

- Both brokers have fixed prices on ASX trading.

- Both offer CHESS sponsorship on ASX trades.

- Both brokers offer access to US shares alongside ASX trading.

- Stake’s App is better but is more trader-focused (which I don’t like).

- Selfwealth has fixed pricing on US share trading.

- Stake doesn’t charge a US brokerage fee per transaction (e.g. to buy or sell Apple shares) — it makes money when you transfer AUD -> USD.

- Stake has an impressive technology stack and is more “nimble” than Selfwealth or Commsec, but it’s not as time-tested as Selfwealth or Commsec.

I’d encourage you to ‘test drive’ all of the brokers I talk about, and read their Terms (available on their websites) before settling on one to use. Remember, you can use more than one.

Click here for Selfwealth (free trades are available on sign-up)

Click here for Stake (we don’t have a coupon code)

If you use Stake and want to share your referral code in the Rask Community, feel free. Again, we don’t benefit from sharing codes, nor do we/Rask want to be involved with that type of arrangement.

Summary

In summary, there are many different platforms you can use to trade ETFs or shares, not just the names we mentioned here. Each of them have its pros and cons. Some are better at one thing (e.g. low-cost ETFs), others will be better for certain things like accessing different markets (Commsec), asset classes or types of investing (e.g. individual shares through Stake or Selfwealth).

Please note that I’m not ‘endorsing’ or recommending any these brokers by listing them here. At the end of the day, you should always speak to a licensed financial adviser, read the broker’s Terms & FSG, and check the broker’s Australian Financial Services Licence (AFSL) on the ASIC Professional Registers before proceeding.

View our other guides: